Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Table Of Contents

By Jason Watson, CPA

By Jason Watson, CPA

Posted Sunday, October 29, 2023

S Corp shareholders are allocated net ordinary business income (profits) as a percentage of ownership whereas multi-member LLC’s use an Operating Agreement. Electing S Corp status in certain situations can create headaches for silent partner or angel investor situations, and other non-traditional ownership structures.

Recall in a previous chapter, an S Corp election can be problematic for partnerships or multi-member LLCs who have an Eat What You Kill revenue and profit arrangement. For example, WCG has a client where the entity was comprised of two insurance sales agents. They created a multi-member limited liability company to share in some of the costs and to gain some economies of scale by working together. After common expenses were paid, the Operating Agreement allocated remaining profits as a percentage of revenue generated by each of the partners. So, one year could be 60-40 and the next year could be 45-55. This worked fine with no problems.

However, if this multi-member LLC elected to be taxed as an S corporation the arrangement blows up since shareholder allocations and eventual distributions must be made on a pro-rata basis of ownership. In using the above example, an insurance agent might be a 50% shareholder but should only receive 40% of the distributions according to the income split agreement. This is no bueno which is Spanish for no bueno.

Here is why this is a problem-

| Net Business Income | 100,000 | |

| Batman | Robin | |

| Beginning Shareholder Basis | 5,000 | 5,000 |

| Allocated Income | 50,000 | 50,000 |

| Ending Shareholder Basis | 55,000 | 55,000 |

| Shareholder Distributions | 60,000 | 40,000 |

| Ending Shareholder Basis | -5,000 | 15,000 |

In this example, Batman is receiving 60% of the distributions as a 50% shareholder. The negative ending basis cannot happen without ugly consequences in S Corps (we call this a shareholder distribution in excess of shareholder basis which causes a capital gains tax event).

You could solve this by changing salaries- however this usually creates unnecessary additional payroll tax burdens in the attempt to equalize the income. Let’s say you must pay Batman $15,000 more in salary to “equalize” the eat what you kill income split. This would cause about $2,000 in additional payroll taxes to be paid unnecessarily. Furthermore, the equalization calculation is circular since as you increase wages for one shareholder it reduces the remaining income for both shareholders. Yuck.

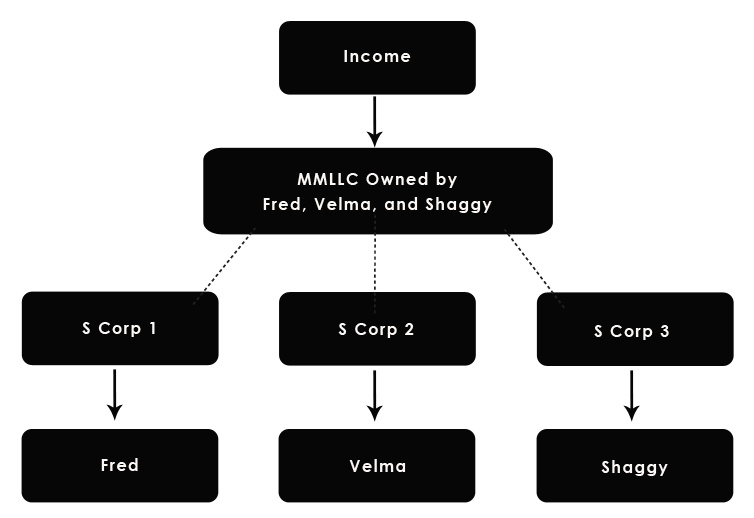

A more elegant way to solve this problem, as mentioned in our chapter dedicated to customized entity structures, is to simply create two more S corporations who are 50-50 members of the multi-member LLC (MMLLC). The Operating Agreement will still dictate the pro-rata share of distributions on a fluctuating basis yet the ultimate income is sheltered by the taxation of an S Corp. We did this in the insurance agency example, and each insurance sales agent was 100% owner of his or her respective S Corp.

Also, in that chapter on customized entity structures, and specifically the mothership baby S Corp construct, we recommended a fee for service or management fee arrangement in contrast to the S Corps being members of the MMLLC.

Here is that schematic again from a previous chapter (there are all kinds of good stuff in there).

Similar problems occur with minority shareholders or silent investors. The author, Jason Watson, served on a jury trial in 2003 when 50 Cent was singing In Da Club. An S corporation was formed with three people. One owner was a 10% shareholder, while the other two were split evenly as a husband-and-wife team. Not looking good from the start.

The minority shareholder, the 10% guy, was constructively ousted from the daily operations of the business. He was not paid a salary. He did not receive any money from the business. Distributions were not made to any shareholder, but the husband-and-wife team paid themselves a salary and used expense reimbursements as a way to funnel money out.

The business began earning money, lots of money, and the minority shareholder was getting K-1s showing taxable income of several thousands of dollars. Good right? No. Not good. He had to report taxable income, but never saw any money in the form of a shareholder distribution. The husband-and-wife team were upset too since they could not take distributions without having to pay the minority shareholder. No one was willing to budge.

Sidebar: Had this entity had a strong Operating Agreement which forced distributions, minority problems can be avoided. One of the provisions we advocate for when working with attorneys is to establish a cash reserve (working capital) for operations and then distribute 40% of the remaining amount periodically throughout the year. This forces the entity to at least cover the shareholders’ typical tax obligation associated with the K-1 income.