Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Hey - Our site just had a makeover and we are sorting through the hiccups!

Hey - Our site just had a makeover and we are sorting through the hiccups!

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Posted Thursday, August 7, 2025

Table Of Contents

Multi-entity business structures can create tax benefits, but more importantly they create flexibility and provide for long-term options when combined with robust operating agreements. Unlike some attorneys and wealth managers, WCG does not automatically recommend complicated business structures. Far too often we see half-baked ideas and unnecessary complication in the pursuit of precision. Rather, we call this the illusion of precision. So many things look cool and sexy on paper with color-coded symbols with arrows going everywhere… this owns 2% of that, that owns 51% of this, the whole thing is owned by 27 different LLCs, and blah blah blah.

Multi-entity business structures can create tax benefits, but more importantly they create flexibility and provide for long-term options when combined with robust operating agreements. Unlike some attorneys and wealth managers, WCG does not automatically recommend complicated business structures. Far too often we see half-baked ideas and unnecessary complication in the pursuit of precision. Rather, we call this the illusion of precision. So many things look cool and sexy on paper with color-coded symbols with arrows going everywhere… this owns 2% of that, that owns 51% of this, the whole thing is owned by 27 different LLCs, and blah blah blah.

Granted, there are times when complication is required, and complication can be elegant if done correctly. Be careful. Get informed. Ask pointed questions. Schematics don’t hold up well in court, but operating agreements and shareholder agreements do… so ensure your pretty picture has some supporting text, preferably signed.

There are certain topic where we concentrate snippets of information that is all interconnected allowing you to get a quick 30,000 foot perspective. This material comes from Chapter 2 of our book titled Taxpayer’s Comprehensive Guide to LLCs and S Corps. You can read it online for free… or a print copy from Amazon, a digital copy from Kindle or a PDF copy from ClickBank.

We also have a rental property and real estate version later on from our book I Just Got A Rental, What Do I Do? For now… here we go…

Business structures types and typically include the Limited Liability Company (LLC)—available as single-member or multi-member (sometimes with a professional variant, PLLC)—which offers simplicity, tax efficiency, and liability protection. The C Corporation remains a viable option for professionals needing formal governance, employee stock options, or seeking venture capital, though it generally incurs higher corporate tax rates and lacks certain tax deductions. Though often discussed, the S Corporation is not a distinct entity type but rather a tax election applied to underlying entities—such as an LLC or Corporation—to help reduce self-employment taxes.

Neat! Now that we have that out of the way, let’s move along to the fun stuff.

In more complex arrangements, business owners might adopt and deploy multi-entity structures—such as holding companies, management companies, or tiered LLCs—to gain increased tax flexibility, liability compartmentalization, and long-term planning advantages. These structures rely heavily on robust Operating Agreements or Shareholder Agreements including other deal structures to clearly define the rules of the road.

Let’s get into this and walk through some business structure examples-

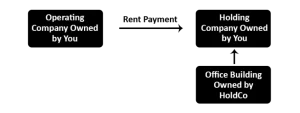

This is a common arrangement where your operating company leases space from your holding company, such as an office building, warehouse, land, equipment, etc. This can also reduce self-employment taxes in the operating company since some of the available cash will be paid to you as a rent payment, and rental income in this situation is normally not subjected to self-employment taxes.

This is a common arrangement where your operating company leases space from your holding company, such as an office building, warehouse, land, equipment, etc. This can also reduce self-employment taxes in the operating company since some of the available cash will be paid to you as a rent payment, and rental income in this situation is normally not subjected to self-employment taxes.

Don’t forget the value of the Treasury Regulations 1.469-4 election where you group your operating activity with your self-rental allowing you to use self-rental losses (PropCo) to offset operating company profits (OpCo).

This is also flexible for the future since you could expand ownership in your operating company without affecting your holding company. Another way to look at the holding company is a vehicle to build wealth separately from your business. [More]

With respects to operating agreements, the subsidiary LLC’s can have a basic operating agreement since its sole member is the holding LLC. The holding LLC might need a robust operating agreement based on your legal needs and estate planning.

Sure, you could have two S Corps, one for you and one for your spouse, but that increases administrative fees such as tax preparation, payroll processing, etc. [More]

Keep in mind that your spouse would not own the multi-member limited liability company (MMLLC) subsidiary entity; rather, the S Corp would own a portion of it, and the other portion would be owned by the new member. Also keep in mind that they sell way more yoga pants than yoga mats. [More]

Backup for a moment. If this multi-member LLC was not taxed as an S corporation, the Operating Agreement could dictate a different schedule of distributions. For example, you and another insurance agent team up. But you want an Eat What You Kill revenue model. In this case, you could be 50-50 partners, but have the distributions be tied to the production of each insurance agent. No problem. In other words your capital accounts are 50-50, your equity is 50-50, but your allocation of profits and losses fluctuate each year. However, if you S Corp elect this to save a few bucks on self-employment taxes, and it blows up.

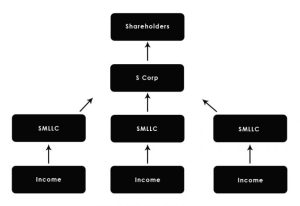

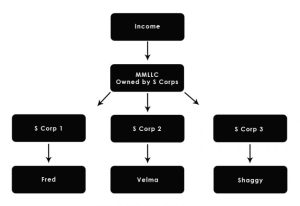

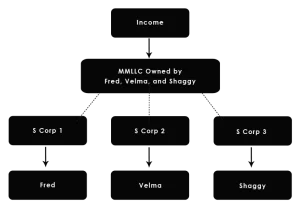

What can be done? The graphic shows the general business structure. Also, this multi-entity arrangement allows for each owner to have discretion within his or her S Corp for fringe benefits such as company automobiles and paying children, among other benefits. Wanna cruise to Vegas with the spouse who is on payroll to take in some conference presentations while also sipping some margaritas as Cabo Wabo? And! Not have to explain to your other business partners the line item expense for your evening?

We call this the Mothership Baby S Corp construct.

Quick Sidebar: When getting involved with non-spouse business partners, Operating Agreements are absolutely necessary. Please read our operating agreements section from our book about some of the basic considerations when drafting operating agreements.

This construct as we say is super popular with financial advisors and insurance agents. Having said that, it is common in any sales or personal goodwill environment, or any situation where the owners want some anonymity and flexibility with their own tax footprint. [More]

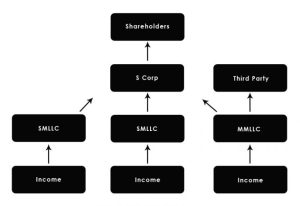

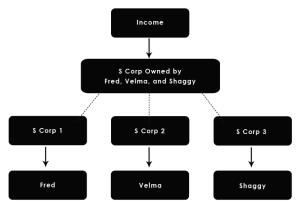

A simpler way to accomplish the same thing as above is to create three entities again, but the multi-member LLC is owned by you and the other guy, not the S corporations. The following is the preferred arrangement for a host of reasons, especially state apportionment of income and business valuation. The S Corps issue consultation, fee for service or management fee invoices to the multi-member LLC in the amount of the revenue split driving the multi-member LLC income down to zero, or some nominal amount like $500.

A simpler way to accomplish the same thing as above is to create three entities again, but the multi-member LLC is owned by you and the other guy, not the S corporations. The following is the preferred arrangement for a host of reasons, especially state apportionment of income and business valuation. The S Corps issue consultation, fee for service or management fee invoices to the multi-member LLC in the amount of the revenue split driving the multi-member LLC income down to zero, or some nominal amount like $500.

Just like the Mothership Baby S Corp Construct above, this business structure is super common with physician groups, insurance agents, financial advisors and other production-based groups that want real time flexibility on the sharing of profits and the tax efficiency of an S corporation. [More]

California’s LLCs, including SMLLCs and MMLLCs, have an LLC fee based on gross receipts. Read that again. On gross receipts. If you make a $1,000,000 and have $950,000 in expenses, you still pay a franchise tax, called an LLC fee, on the $1,000,000. The fee is “banded” as we say since it is not a straight calculation based on a percentage. As of December 2024, the following fees are reported by California’s Franchise Tax Board–

| Gross Receipts | LLC Fee |

| 250,000 to 499,999 | 900 |

| 500,000 to 999,999 | 2,500 |

| 1,000,000 to 4,999,999 | 6,000 |

| 5,000,000 + | 11,790 |

The MMLLC S Corp would not pay salaries to its shareholders since the income is so low, and there isn’t any cash available. In addition, distributions theoretically should be $0 since all the cash is leaving in the form of payments to the other S Corps.

The net-net to the this is that the mothership is being taxed as an S Corp, but doesn’t have enough profits to warrant reasonable shareholder salary since all the profits are paid out as a fee for service according to a contract. [More]

As such, an LLC is created in Wyoming given their low annual costs plus anonymity (other states work too, but Wyoming is nice). Next, LLCs are created in Montana, Colorado and Texas. Keep in mind the order here. The parent, the Wyoming LLC, needs to exist first since the child LLCs will be wholly owned by the parent LLC. In other words, each rental property will be owned by an LLC that has a single-member, and that single-member is the parent LLC. [More]

Holding companies and management companies are not the same thing. One, as the name suggests, holds or owns underlying assets (other businesses). The other offers management services in exchange for fees, and typically doesn’t own underlying assets.

Quite a few entrepreneurs have their hands in a lot of pots, and for various reasons they want to set up multiple entities (typically limited liability companies or LLCs). They might want separate liability protection in their contracts. One entity might have multiple owners or have a separate team of employees with future minority owners. One of the entities might be regulated such as real estate or financial services. Yet another entity might be in a growth phase for a business sale.

Compartmentalization can be important as well to those who like straight lines and organization. The question then becomes whether to use a Holding Company or Management Company arrangement. [More]

There are some things you need to work through with the multi-entity arrangement, and have detailed in operating agreements (such as naming principles for purposes of professional liability insurance). Depending on your situation, some of these things might be show-stoppers. However, don’t take the first answer as the only answer. Here is a quick list-

As mentioned, some of these could stop the show. [More]

What is a multi-entity business structure?

A multi-entity business structure involves operating two or more legally separate businesses to provide flexibility but also tax benefits.

When should I consider a multi-entity business formation?

A multi-entity arrangement is considered when there are multiple business owners with different risk profiles and tax footprints, especially in a variable profit split environment.

How does a holding company and operating company structure work?

A holding company owns the equity of one or more operating companies, which run day-to-day business operations, helping isolate liabilities and centralize control. Each subsidiary has a separate checking account… separate books… separate life… but report in a consolidated fashion on the tax return.

What are the tax benefits of multi-entity structures?

Benefits include flexible income splitting, state tax optimization (control the tax narrative), and flexible business expenses based on personal habits and risk profiles.

Can a multi-entity structure help with asset protection?

Yes—by separating assets into different entities, you reduce the risk of one entity’s liabilities impacting another. Having said this, this is all theoretical since you, the human, are the connective tissue.

How do operating agreements work for multi-entity businesses?

How do operating agreements work for multi-entity businesses?

Operating agreements set the rules for management, profit distribution, and decision-making, and can be tailored to account for the relationships between entities.

What legal agreements might be needed between LLCs in a multi-entity business structure?

Common agreements include leases, service contracts, and licensing arrangements to document transactions between related entities. The key element is the business purpose- the commercial substance between entities must be ordinary and necessary, and not considered self-dealing.

What are the pros and cons of multi-entity structures?

Pros include liability separation, tax planning opportunities, flexibility, and asset protection; cons include higher setup costs, more administrative work, and compliance complexity. But baby, I’m worth it.

Can multi-entity structures be used for real estate businesses?

Absolutely—many investors place each property in its own LLC, with a holding company for central management and financing.

Are there special tax filings for multi-entity LLC structures?

Not really. In many ways, especially in the Mothership Baby S Corp construct where a fee for service arrangement is deployed, tax footprints and therefore special tax filings are reduced.

Do I need separate bank accounts for each entity?

Yes—keeping finances separate maintains the liability shield and ensures proper accounting. That is the nerdy lawyer answer. Practically, it is easier to reconcile bank accounts as you rush towards a tax return.

What is a multi‑entity tiered structure for rental properties?

It’s a layered structure where one LLC (often in a state like Wyoming) acts as a holding company, owning multiple “child” LLCs that hold individual rental properties—offering anonymity and estate planning advantages.

Why might I choose a manager‑managed structure for a rental holding company?

A manager‑managed structure helps ensure your holding LLC—such as one based in Wyoming—is not considered to be conducting business in states like Colorado, Montana, or Texas, reducing registration obligations.

Can a tiered structure provide estate planning and anonymity benefits?

Yes—the layered approach, where each property sits within its own LLC under a central holding entity, can enhance privacy and streamline estate planning.

Are there downsides to using many entities for rental properties?

Complexity always adds stress, cost, compliance related chores, etc. As such, when we are heading down this path, we want to ensure it is meaningful and impactful, and aligns with your objectives.

Table Of Contents

Tax planning season is here! Let's schedule a time to review tax reduction strategies and generate a mock tax return.

Tired of maintaining your own books? Seems like a chore to offload?

Did you want to chat about this? Holding company operating company structure? Do you have any questions for us? Let’s chat!

The tax advisors, business consultants and rental property experts at WCG CPAs & Advisors are not salespeople; we are not putting lipstick on a pig expecting you to love it. Our job remains being professionally detached, giving you information and letting you decide within our ethical guidelines and your risk profiles.

We see far too many crazy schemes and half-baked ideas from attorneys and wealth managers. In some cases, they are good ideas. In most cases, all the entities, layering and mixed ownership is only the illusion of precision. As Chris Rock says, just because you can drive your car with your feet doesn’t make it a good idea. In other words, let’s not automatically convert “you can” into “you must.”

Let’s chat so you can be smart about it.

We typically schedule a 20-minute complimentary quick chat with one of our Partners or our amazing Senior Tax Professionals to determine if we are a good fit for each other, and how an engagement with our team looks. Tax returns only? Business advisory? Tax strategy and planning? Rental property support?

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.