Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Hey - Our site just had a makeover and we are sorting through the hiccups!

Hey - Our site just had a makeover and we are sorting through the hiccups!

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Posted Monday, June 2, 2025

Table Of Contents

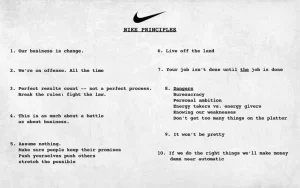

WCG is always looking for business-oriented public accounting professionals to add to our amazing team. We have been fortunate with rocket growth which is certainly a good problem to have… but a bad one since we need to find capable people who are like-minded. Is that you? Here are some WCG quick stats as of October 4, 2025-

WCG is always looking for business-oriented public accounting professionals to add to our amazing team. We have been fortunate with rocket growth which is certainly a good problem to have… but a bad one since we need to find capable people who are like-minded. Is that you? Here are some WCG quick stats as of October 4, 2025-

2025 Revenue

14.0M in 2026

Full Time Team Members

95 total WCGers

In-Office Team Members

Colorado Springs

Female Team Members

66%

Female Partners

avg age of 53

Team Members Under 40

65%

CPAs

Enrolled Agents

Here are current employment opportunities as of Saturday, October 4, 2025-

Business Development – Payroll Specialist

Position ClosedBusiness Development – Inside Sales

Position ClosedOperations Manager

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedClient Support Manager

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedClient Support / Front Desk

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedInternship (Spring 2025)

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedAccounting Services Manager

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedAccounting Services Supervisor

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedAccounting Services (bookkeeper)

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedRental Expert Pod

Learn MoreTax Support Supervisor

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedTax Support (seasonal)

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedTax Accountant

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedTax Supervisor

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedTax Manager

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Position ClosedAll our positions are available at all locations. We entertain 100% remote positions for new team members who have been remote in the past with success. Quality training and absorbing our DNA is strained when limited to Teams, phone calls and emails (but we make it work!).

Our Open positions above are only because we are continuously looking for great people to join our team. WCG is in a good spot with a solid team. We are not filling a position or operating in crisis mode, but we always entertain adding value and contribution to our team.

First, we are cool. Second, we kick ass at what we do. It gets precipitously more boring from there with a quick list of why we believe WCG is unique to the accounting industry-

No billable hours. We use value-based billing.

No A/R. We get paid upfront for our services, except tax preparation (but we collect our fee before we file).

As a firm, we check email on Mondays and Thursdays only, with auto-responders on Tuesdays and Wednesdays that read “Hey, I will respond in 3 days. If you are on fire, please call us!” Email, especially boomerang emails, can suck you in and ruin your whole day. There are no such things as accounting emergencies- only poor planning. When’s the last time you emailed your doctor or dentist or hair stylist? Clients can exercise some restraint.

We are hybrid, but do the same days as a firm each week. During the summer, we are remote on Mondays, Thursdays and Fridays (with the tax team off on Fridays). Outside of summer (aka tax season), we are remote on Mondays and Fridays. This ensures when we are together in the office, we are all together. Good for potlucks and after work drinks, but especially good for spurious collaboration and quickie decision-making.

We are hybrid, but do the same days as a firm each week. During the summer, we are remote on Mondays, Thursdays and Fridays (with the tax team off on Fridays). Outside of summer (aka tax season), we are remote on Mondays and Fridays. This ensures when we are together in the office, we are all together. Good for potlucks and after work drinks, but especially good for spurious collaboration and quickie decision-making.

As a firm, we are closed from April’s filing day for about a week. The tax team including tax support continues its holiday for another week towards the end of April. We are also closed for the week following October’s filing deadline. Thanksgiving week is light duty on Monday and Tuesday, with rest of the week off. July 4 week is similar (depending on how it lays out) but the week is usually light duty. We have several late starts (after Superbowl and July 4), and we have several days off just because. We don’t need to see butts in seats to see value and contribution. (a lot of us stand anyway)

We disengage from bad engagements frequently. We pay little attention to the billings, but we are sensitive to the fiscally irresponsible client, the tax scammer and the mean person. We want collaborative relationships, otherwise you can add CPA to your shopping list. We don’t look for trouble, because you’ll find that too, but we don’t tolerate nonsense.

We have a Mother’s Day List (the MDL) where throughout tax season, everyone adds the good, the bad and the ugly. Then in May, we all get together as a team, with remote managers and directors flying in, and go through what we did right, and what things we should forget (and never do again). It is a great exercise in being a better firm and better team. Same thing for Thanksgiving (the TDL)… this is combined with our “slash week” where we review the TDL / do some annual training / tax kickoff / have our holiday dinner. All remote team members are flown in once a year including their spouses. Yes, we have meetings and whatnot, but we also have drinks and dinners.Yes, we have slash week t-shirts. You would look lovely in one.

We have a wonderful team of remote tax and accounting professionals. We have always been an online tax accountant firm with clients all over the world. Since our client base is mobile or at least outside of Colorado, our team can be anywhere! As a result, we have a great nucleus of protons and neutrons in Colorado Springs to provide the backbone of a solid in-person team environment, and then we have a bunch of orbiting electrons. Did we take that too far?

We are very aware of the team member experience, and one of those pillars is a strong training foundation. Everyone starts with a series of home study modules including quizzes (oh, don’t groan… we could bore you to tears with slide decks if you rather). You are compensated for home study.

For the tax team including tax support roles, we only start in November. Yes, we leave room for exceptions such as pre-scheduled vacations, funerals (kidding) and other obligations.

Why November for tax team? Good question! In the past, we’ve discovered that summer is too idle of a time for people to feel valued and have a sense of belonging. Sure, we are working on tax plans and whatnot, but the brain power is low and it creates a bit of emptiness for new team members.

What if you cannot wait until November? We understand, and we wish you the very best- we’ll always be here should your ambitions or circumstances change. As an abstract, we ask you this- are running away from something, or running towards something? We could sound like Mom, and say all good things come to those who wait. Frankly, if you think our team is cool, and it is, and if you believe your future is with WCG CPAs & Advisors, and it might be, then waiting a handful of months for the perfect fit is well worth it.

We tend to put two cohorts together of 5-6 tax and accounting professionals each for a total of 10-12. This allows you to have a tribe within the team.

Update: As of June 9, we have 4 new tax team members starting with us in November. Welcome Abbie, April, Helen and Stuart.

Your first 30 days are mapped out according to your position. Click here for a Sample Training Schedule. Our training delivery is a mixture of home study, videos, test clients and simulations, and third party programs. After the first two weeks, training is still scheduled but is more sporadic, and team role-dependent (including season… tax, tax planning, Q4, etc.).

Training dates are mostly immovable. We have a plan, and it involves many people. As such changes and accommodations are very disruptive. Having said that, if there are circumstances such as planned weddings, or grandma’s 80th birthday in Maui, or something, we can review and discuss. However, we might not be able to fully accommodate.

We have a full-time trainer plus two others to round out our on-going Training Team. For our remote staff, also known as rWCGers, we fly you into Denver on Sunday, and you fly home on Friday for the first week of training. Yes, we get you a rental car and a hotel, usually at the Drury because they have free happy hour and we all pile into your room (kidding).

We also have an annual Tax Kickoff nestled into our Slash Week described above, and mixed throughout the year are weekly Tax Prep meetings (tax camp, like band camp) and periodic All-Hands (firmwide) meetings. We also have 2-day Business Consultation training annually, and we are adding Rental Property Consultation. This coincides with our two books since content-based marketing is how most clients find us.

WCG has a 12-18 month calendar that shows all training sessions, office closures and other important activities to help you plan your life in advance.

WCG is a progressive firm in Colorado Springs who only engages with small business owners (S Corps, Partnerships, PCs), rental property owners and real estate investors, and complex individual tax preparation. We take a consultative approach to our client engagements by offering routine consultation and a strong focus on tax planning and business advisory services. Tax return quality and efficiency naturally occurs from periodic client interaction throughout the year.

Charge hours? Not us. Tracking time to the 6-minute increment? No way. While WCG has hourly rates for open-ended projects and other craziness, we operate with a value pricing approach offering fixed fee ranges (some call this impact pricing). We only take on the work we know we can do, and as such we don’t need billable hours. Additionally, we assess each team member on their output, not their input. And! Not all output is the same… so many people add value to an operation who don’t have a specific deliverable.

Don’t get us wrong, however- We have metrics. We have goals. We still must perform and as such we need to monitor operations to ensure success and a great client experience. We must all cross the finish line together. If only most of us cross the finish line, then we fail… we all must cross it, together, as a team. To that end, workloads are continuously monitored and balanced.

While we don’t have charge hours, we track time for certain activities- tax return preparation, tax planning and accounting services. For tax related stuff, we track time simply to understand what went into the tax return. It is not monitored too severely- more inquisitive as needed than quantitative. For accounting services, we track time for scope creep analysis. Two bank accounts becomes four bank accounts and two locations- we need to adjust fees to align with the value and effort.

Everyone clocks in and clocks out- we must be able to track your time should it be necessary. But what is not required is recording everything you do. Got a coffee, 6 minutes. Read and responded to email, 48 minutes. Took a phone call, 12 minutes. Yuck. Having said, new WCGers must track time in 0.25 increments for the first several weeks to identify time traps and other issues (see Work Life Balance below, like way below).

The review process, whether it is tax return preparation and financial statement delivery, is a collaborative process. Our tax return reviews are not met with “let’s see what is wrong.” Rather, fixing small mistakes and making adjustments is part of the tax return preparation process. That is our entire WCG philosophy. Sure, if you make the same mistake twice or there is some nugget of coolness that will help you next time, we’ll definitely mention it. At the risk of repeating ourselves, making tweaks and finishing touches to any deliverable is part of the process, and not some contest to be won.

WCG also embraces technology as much as we can- client portals, client management systems including phone apps, text messaging, electronic workflow, some automation (humans are still needed), 100% cloud-based computing, custom online digital forms, esignatures for authorizations and approvals, etc. Working smarter rather than harder is a part of our fabric. Over 80% of our clients are outside of Colorado. WCG has been a technology leader in so many ways and we remain a pioneer in the online accounting and CPA firm space.

Having said that, we do not hop around and chase the next best thing. Software and overall tech changes can be very disruptive, and at times you solve a bunch of issues while creating a new set. Changes must be methodical, and above all, impactful and sustainable. A nice balance between the young kids and old-man Harold at the wheel.

Let’s take a moment to carve out just the tax team. Since it is the most visible from a workload perspective, we’ve created a Tax Team Expectations and Path spreadsheet. Sure, it is a bit simplistic, but it provides an idea of the workload, and how you can advance your career within the WCG Tax Team.

What the heck does “in-training” mean on the tax team path? Good question, and a common one. Regardless of your experience levels, your first 6 months (generally the regular tax season) will be primarily tax return preparation. Sure, you might have reviewed a kazillion tax returns with your last team, but we need you to learn how we make the sandwich. Are we a pickles on top sort of team? Do we cut a sandwich, and if so, which way? Of course, onions go on the bottom; everyone knows that.

So, you need reps in the gym so to speak to absorb our DNA, and to garner proficiency and subsequently credibility. Keep in mind that it does us no good to hold you back- WCG CPAs & Advisors will go as fast as your absorption rate will allow. As such, “in-training” simply means a temporary shift in expectations and workloads during this phase.

We currently have several CPAs and EAs, and we require all accountants to either be on the CPA track or obtain the EA credential within 6-9 months depending on the calendar. With our steady growth of about $2,000,000 to $2,200,000 in revenue annually, we are in need of 10-12 additional experienced business-minded tax and accounting professionals to adopt current clients as their own and help run a team. If we cannot add to the team, then we must modulate our growth. Methodical growth is good; growth you cannot service or growth that is crazy-hair is very disruptive.

Each partner (Tina, Jason, Sally, Michelle, Rachael and Megan) and two of our tax managers (Ethan and Brooke) have a small subteam of 5-6 tax professionals which we call Pods. This allows for more intimacy among the client manager or partner, the client and the people doing the work. It also allows for better workload management and balancing. Yes, we have an operations manager plus a supervisor to keep the trainings running on time from a macro / firm-wide level, but each Pod manages their world from a micro level. When you are on larger teams or in a pool of other accountants, you can lose touch with the client mission and you can also lose the sense of belonging.

Pods work well. There is also some healthy competition within each Pod and between Pods. Fun!

Podmates, yes, that is a word, meet weekly via Teams to discuss problems, workload balancing, etc. The meetings are more sporadic during the summer. This is a great way to remain connected with your tribe within the firm. Jason’s Pod is entirely remote; Megan’s Pod is mostly remote with only one person in-office; Rachael’s Pod is also 100% remote.

Do you want to lead your own Pod one day?

We recorded five podcasts hosted by Jason Watson, Senior Partner alongside Jason Schneider and Megan Oeltjenbruns who are also Partners. Recorded in 2022 they might be a bit outdated, but the fabric of who we are hasn’t changed much. The one on the left is titled Life and Leadership. Here are the other podcasts in video format (all our podcasts are also video-recorded).

Some people reach a point in their career where they want to be compensated purely for their experience. They’ve paid their dues. They’ve cut their teeth. Whatever you want to call it. However, the problem with that approach is that you didn’t pay your dues or cut your teeth with WCG. Some other tax and accounting firm, or perhaps a series of firms, received that benefit.

A decade of hard work and dedication to the team… the WCG team… is what we need. Sure, your experience is valuable- no doubt. We get it, and the team needs it. We just need to find the proper context and insertion point. Heck, we’ve had Tax Managers make Partner in under 4 years. So, No, old man Harold doesn’t have to pass away for you to find career progression.

With that in mind, we will take you anywhere you want to go. Manager? Partner? Thought leader? Brand Ambassador? Anywhere!

With that in mind, we will take you anywhere you want to go. Manager? Partner? Thought leader? Brand Ambassador? Anywhere!

Love tax prep? Love tax return reviews? Love managing client engagements? Can’t stand that stuff? Prospect calls make your skin crawl? No worries… there are a zillion ways to contribute to the WCG team.

Having said all that, and using tax professional as an example, to be successful in any supervisory or managerial role at WCG, you must know how our sausage gets made. It is impossible to step into a world on day 1 and then on day 2 offer guidance or even respectful criticism to other people’s work. You have expertise, and maybe even some credibility, but zero rapport. You might even be wrong in your review. Again, because you don’t how WCG in particular makes the sausage. We need to protect you, as well as train, encourage and promote you.

As such, and to ensure your success as a new tax professional (for example), we put you into tax return and tax plan preparation modes right away. Yes, you might have been signing tax returns at your previous firm. Yes, you might have been a team leader. We get it, and we will get you back to that spot and beyond. It makes absolutely no sense to hold anyone back or not fully leverage their skillset to achieve highest and best use. None. Nada. Zip.

The button below is to our Tax Team Career Path, and it shows the progression from tax return preparation to tax return review, including client management. Check it out!

Again, our tribe… your tribe… will take you anywhere you want to go!

To piggyback on the gibberish above, here are some things that give us some hesitancy.

Seems silly, yes, but more than 7-10 years of experience, we start to fall into that paid for experience trap described above.

Hybrid doesn’t really count, right? This isn’t a show-stopper, but we need to dig into your reasoning and also how you plan to remain connected to the team. Not everyone needs the social aspect woven into their professional life, but some do. If you are wanting to join our team in a remote capacity, it can be quite isolating and lonely if you are used to office parties, lunches, chatter in the hallway, etc. WCG is very aware of this has taken a bunch of steps to ensure our remote team remains connected (we also have a Social / Internal Team Support committee).

WCG is a tiny little firm. We don’t have locations scattered across the U.S. with all kinds of experience, depth, service lines (and the career paths that are offered with that), etc. We have had people from top 20 firms join our team, and it rarely leads to a good fit. Our engagements are smaller. We are generalists. We don’t have billable hours. We need to have urgency. If you are wanting to make an impact with your team and adopt this firm as your own, well, that is a different story.

We touch a lot of tax returns and tax plans. What’s a lot? 250-300 tax return “touches” whether it’s preparation or reviewing is not unusual (see Tax Team Career Path button above). So, if you come from a firm that doesn’t have this high-volume low-touch high-urgency approach, it is tough to spool up to our way of life. This is the largest culprit when new WCGers struggle- just not used to the speed. We work hard, and play harder. We hate extensions and love our summers.

While these might not seem fair, this is simply a culmination of our experiences. We leave room for the unicorn… for the person who says, “hey, I’m coming from a big brand-name firm and I know in my heart of hearts that I want a smaller and more intimate team that focuses primarily on compliance and small business advisory, and here are the 185 reasons I feel this way…” You don’t have to tell us all 185 reasons… pick your top 3. You can work in the remaining 182 after you join the team.

The tax team needs strong reviewers- it is our biggest limiting factor. However, to be a good reviewer you need to prepare tax returns to fully understand our procedures, tax positions, level of penny-perfect craziness, how WCG does business, etc. To step right into a reviewer role will never happen. Having said that, it does us absolutely no good to hold you back- if you are crushing it, and you have a high give-a-damn factor, then we will accelerate your timeline. We need reviewers and client managers, but it is a process.

If you are someone who needs straight-lines, clean garages and balance sheets, we might not be the team for you. Half our business owners don’t use formalized accounting, and half of the other half shouldn’t get close to QuickBooks let alone use it. Properly prepared financial statements are a luxury with our client base. Will you see negative accounts receivable? Yes. Will you see negative cash? Yes. The question is, will you freak out about it? We get balance sheets from clients- no because of the client, but because we asked for them. Do we have to use them? No. Do we always prepare a Schedule L with our business tax returns? Yes. Always. There in lies the rub.

If you have a returning one-person S Corp with a 1099-NEC for revenue, ending cash for the year, payroll details and a handful of totaled expenses, that tax return should take longer to clear diagnostics from the software than actual preparation. Get in, get out and move along because the next tax return might be a doozie. You must be able to give yourself permission to send a tax return to a client after spending only 20 minutes preparing it.

Right, wrong or indifferent, the accounting industry relies heavily on email communication. To be successful at WCG you must have excellent email skills- organization and response time are obvious, but also the ability to quickly synthesize what the client is asking and then quickly pound out the answer (spoiler alert, a phone call might actually be faster than writing wall to wall answers and it adds a touch point to the client).

WCG is continuously analyzing email and the chore it has become. As mentioned elsewhere, email is a trap and our industry and the taxpaying client base needs to change. You don’t email your doctor continuously, so why do you email me continuously? My inbox is not your Google search bar- while we appreciate the confidence clients have extended, at times you wonder if it is simply the easy way out. “Mom, I can’t find my backpack.” Did you spent 3 seconds looking for it, or 15 minutes?

We cut down on email days to two per week, and we are experimenting with other things to cut down on the chore of email.

Sidebar: All teams, including tax support and tax preparation teams, are encouraged to communicate with clients. In the beginning you will likely be on “email probation” where a senior team member will review to ensure a) you aren’t asking for something that we already have or know, and b) the way it is being asked aligns with our “one voice” concept. Don’t get too hung up on this… but we do want everyone to be client facing, get that exposure, grow your skills, manage client engagements, and all that jazz.

WCG is not the firm for everyone. Clients, team members, it doesn’t matter. While we are continuously improving and providing a better service to the client and a better home for our team members, we must recognize that our way of doing business is not for everyone. If you are reading this and trying to make it work, then perhaps that is a sign. If you are reading this, and you can’t get enough to the point of sharing the URL with your significant other and family members, then that is a good sign. Yeah, we laid it on a bit thick there. Whatever, we likely made you laugh just the same.

Ah, the most watered down phrase of 2022, 2023 and most of 2024. A lot of people look for new opportunities, and one of the primary reasons is “work life balance.” At WCG (and stated here and there) we want to work hard, yet play harder. Yes, we are playful and funny, and generally have a good time. At the same time, we have a job to do. Our Tax and Accounting Services teams will easily work 55-60 hours a week during busy times, but then we drop down to 30 hours a week during slow times (like lovely summers in Colorado). Client Support and Payroll teams tend to work 40 hours a week.

Sidebar: As mentioned elsewhere, we do not have a strict “you must work xx hours.” However, and this a big however, in our experience, you will need to log 55-60 hours to be successful. If you can do a bunch of work in fewer hours, then good on you.

For some people, there is a pleasure in a “decision-less” period of working hard where all you do is eat, sleep and taxes, and then slide into summer with all sorts of free time to draw up ways to break up the week.

We also take a lot of time off as a firm after filing deadlines and around holidays. This is what we call “macro” work life balance. For example, July 4 in 2025 lands on a Friday. We will be closed on Thursday and Friday with Monday, Tuesday and Wednesday being “lite” duty, and we call Lite RWA (a time where everyone works remotely and it is light duty, low brain power stuff). WCG provides over 23 days of firmwide closures. That’s more than a month! Sure, this includes 7 holidays, but another 16 days just because.

Then there is “micro” work life balance. WCG is compensating you for the work that you produce on an annual basis, and not in the manner in which you do it. If your circadian rhythm is more of a night owl, then you might work Noon to 9PM. Others like to break things up… get up early, get some work done, go to the gym for a couple of hours, get more work done, run some errands, cook dinner, and then get a little more work done. The micro work like balance is up to you. As Jason Watson says, “grades are a deodorant for bad behavior in school. Production is a deodorant for bad behavior at work.” WCG takes care of the macro portion.

What about time zones for our remote team? Given our comments just now, it makes sense that you don’t have to align your work schedule to HQ’s (which is mountain time). As stated elsewhere, our in-office team has tighter hours during the core hours- this is to preserve the nucleus of the firm and keep our team’s DNA alive. However, our remote team does not have this requirement per se. We call you at 10:30AM on a Tuesday, and get your voicemail. Crickets on Teams. Do we care? Nope. Conversely… if we struggle to connect with you, clients are making comments, there are whispers in the virtual hallways, etc. then we might have a concern.

See our Family Leave blurb below.

Our team has a can-do persona and is basically No BS. If your fuel is to work hard when it’s needed and screw around when it’s not, you’ll fit right in. If not, that is OK, but WCG and our team might not be the best fit. What do we mean here?

For 2025’s tax season, we have prepared and filed about 3,700 tax returns which represents 70% of our annual tax prep goal. As you’ve read elsewhere, we hate extensions, and love our summers (another T shirt by the way). New team members can have a hard time with this approach; if you come from a CPA firm where you extend a lot of tax returns, our way of life will either a) rock your world in a bad way or b) plug nicely into your personality.

For 2025’s tax season, we have prepared and filed about 3,700 tax returns which represents 70% of our annual tax prep goal. As you’ve read elsewhere, we hate extensions, and love our summers (another T shirt by the way). New team members can have a hard time with this approach; if you come from a CPA firm where you extend a lot of tax returns, our way of life will either a) rock your world in a bad way or b) plug nicely into your personality.

At the risk of belaboring the heck out of this, our team is small. You can’t hide within a group of 90 or so tax and accounting professionals. Everyone needs to pull their weight as they say. Or… everyone needs to be rowing in the same boat in the same direction, and if you aren’t, you’ll stand out. Yeah, we just said two things that mean the same thing, literally. We can slow you down but we cannot make you go faster—doing things quickly and efficiently must be a part of your DNA.

Summers are a relaxed workload. Fewer hours, sure, but the intensity to the work is also much lower. May, June and July are tax planning months, with some light cleanup in November.

All salaried positions must work 2,100 hours annually / 12-month trailing period. This is not a billable hours threshold, but rather hours working on WCG related activities. Holidays and other office closures count towards the 2,100 hours (e.g., Thanksgiving Day would contribute 8 hours towards the 2,100-hour requirement). PTO and other employee-requested leaves do not count towards the 2,100-hour requirement. As mentioned earlier, we have over 180 hours of firmwide closures that count towards the 2,100.

The only time we dig into your hours, however, is when your goals are not being met. We establish your annual work program (the AWP), which is then reviewed, discussed and approved by you. The AWP includes-

This becomes your commitment to the team, and our commitment to you. Having said this, we might need to make tweaks depending on unforeseen circumstances or other limitations as they come up in real-time. What we don’t do is reward good work with more work; if you can get your AWP accomplished in 1,900 hours instead of 2,100 well then good on you mate!

Full disclosure- All new team members will track their time in 0.25 hour increments for the first several weeks. You can view this as micromanaging if you want. No argument here. However, the true purpose is to identify time traps and other systemic issues to help you succeed. Our way of doing business can be very different to even the most seasoned tax and accounting professional, and our only goal is to get you where you want to be as quickly as you want.

While WCG does not track billable time, and while we don’t care in the manner in which you get your work done but rather that it gets done, there is a direct causal relationship between hours worked and work accomplished. At the risk of repeating ourselves and you rolling your eyes, to be successful on the tax team, our nearly two-decade amount of experience strongly suggests that 55-60 hours a week is required from mid January to early April. Do some work more? Sure. Do some work less because they are efficient and employ their 5 year old to tally up charity donations? Yes. Should you have a baby just for the human calculator like in Hidden Figures? Perhaps.

We work hard. We are stealing capital from you and your family for about 10 weeks, and injecting it into the team and the mission. However, outside of tax season, WCG returns that capital back to you, and you can re-deploy it with friends and family. If your family is not too keen on this approach to tax season, it will be very challenging to find success at WCG.

We are very aware of the team member experience- the 3-way balance of excellent client service, spending quality time with friends and family, and everyone’s individual satisfaction from a job well done, and we believe (of course we do, right?) that we have the ideal blend.

We are going to come right out and say it- if you are putting a bunch of stock into what Glassdoor has to say about us or any other firm, we are likely not a good fit for each other. It is interesting that most Glassdoor posters are anonymous- that is the first clue to the sincerity or accuracy of the content. If you have something to say, and you believe you are correct in your assessment, you should have no problem putting a signature to the words.

Have we made mistakes as a CPA firm? Yes. Have we made interpersonal mistakes as managers and leaders? Yes. Do we continue to evolve, learn and grow? Yes.

The way WCG operates is not for everyone. It is fantasy to think that every accountant is going to fit into all environments. The fact that you are reading these words right now suggests that it is not working out at your present firm, right? You are missing something. They can’t find it or provide it. And here you are… does our team have what you are missing? Maybe, maybe not. Why do you like some people and not others in your personal life? And why should the workplace be any different?

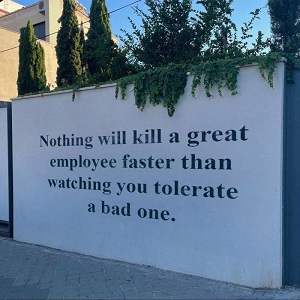

Finally, and as the graphic to the left suggests, our team is wonderful and they have high expectations for themselves individually and as a team- they cannot tolerate a team member that isn’t pulling their weight as they say, and as such the hiring and training process must ensure that the people we add to the team also contribute to the team.

You can ask us about Glassdoor reviews, but we will simply read the above passage to you and likely consider the question itself to be a non-starter. Sorry, not sorry, faux-pologies abound, but anonymous complaining about a previous employer is unprofessional on its face. As a prospective new team member, you can talk to anyone at WCG CPAs & Advisors before deciding to swipe right. Anyone at any time.

Does this sound defensive? Yeah, maybe. Take it for what it’s worth. Imagine if you could leave reviews on Match or Tinder… that would be a hoot.

Wait, what? Sure, we consider ourselves a strong knit team with family-like characteristics, but you really don’t want to work with your family, right? Families usually don’t respect boundaries, exhibit bad behaviors, and apologize for nothing. Sound familiar?

In referencing Mazlow, and the hierarchy of needs, sense of belong is third on the list- above physiological needs and below self-actualization. Specifically, “a sense of belonging—the subjective feeling of deep connection with social groups, physical places, and individual and collective experiences—is a fundamental human need that predicts numerous mental, physical, social, economic, and behavioral outcomes.” We’re getting deep, aren’t we?

Everyone needs to have a sense of belonging, and at times they get that from work. Not everyone does, but some do. People meet their best friend at work. Maybe even a spouse. As such, let’s split hairs and call our team your work family where we respect boundaries, and support and encourage each other, all under the auspice of a business relationship with a client-centric mission.

We require all tax team WCGers to either-

Can you be a partner at WCG without a CPA? Yes! Two partners were EAs before earning their CPAs deep into their career (like 40s and 50s deep). Can you be a partner as a non-tax team member without a credential? Yes! Why not? Since 2001, CPA firms do not need to only have CPAs running them.

Not everyone wants to be a partner. We get it, and that is super OK with us. We are a growing firm, and if being a partner is important to you and you have a lot to contribute to the team as a leader in that capacity, then we can take you there. Quickly.

We also encourage all non-tax team WCGers to obtain their Enrolled Agent credential. It shows commitment to your profession and the industry, and it lets you talk to the IRS and other tax agencies. Payroll specialists used to be able to wiggle around POA stuff with 941s and related payroll docs, and we’ve experienced recent pushback from the IRS.

Finally, WCG has a reimbursement program available including bonuses for both the EA and CPA. Our Associate Handbook outlines the program- at times there is some customization because some people join our team with 3 exams passed, or something similar. As such, we “negotiate” a fair reimbursement and bonus structure.

Super finally… no one, ever, in the history of the accounting industry woke up and said, “Crap! I’m still a CPA. Ugh!” And no one, ever, jumped into the shower and said, “Gotta scrub this CPA off me.” EA or CPA… get it done, be proud and don’t look back.

Moving on to signature stuff- WCG is trying to buck a lot of typical accounting industry trends or standards. One of them is signing tax returns. Of course, our partners sign tax returns, but our experienced tax supervisors and tax managers also sign tax returns. We have a signer probation program including partner review triggers, but overall we are all about nextgen leader development, and on some levels, evolution.

The accounting industry has seen a ton of mergers and acquisitions. On a cynical level, some argue that larger firms are starving for new partners to help fund the exiting partners and their deferred compensation packages. Some argue that it is not a Ponzi scheme per se but rather a land grab, or more aptly said, a talent grab. Private equity has it’s motivations as well.

WCG is not interested in being acquired. Period. Full-stop. Sure, there is a theoretical amount of money to make someone do anything, but no one is writing that check for our little boutique firm in Colorado. Moreover, our revenue is not unique- we are small business generalists who do a lot of compliance work. Not really that sexy.

We have seriously gone down the acquisition path on three occasions. One was a regional firm in Colorado who was similar to WCG. One was a top 20 firm. One was private equity. The regional firm was okay, but they had done some recent acquisitions and the dust hadn’t settled yet. We said no thanks. The top 20 firm was also okay, but our team would have been swallowed up and our identity would be lost. Again, we said no thanks. The private equity was pure nonsense since they wanted an ROI that was simply unobtainable. They said no thanks.

These iterations re-entrenched WCG’s partners, and we’ve made a commitment to transfer ownership and control from within. We used to entertain conversations regarding merger or acquisitions, but today we don’t even answer the door. “Go sell crazy someplace else. We’re all stocked up here.” Our partners are currently in their 40s and 50s, but we are building stratified off-ramps today.

How do we support each other? Here is quick summary of our tech deck and committees.

As mentioned earlier, we are tech-forward but we also understand that changes are disruptive. At times it is better the devil you know than some bad game of whack a mole.

UltraTax by Thompson Reuters is our tax software. We also use Fixed Assets CS, but that is about it. Accounting CS, Practice CS and File Cabinet are clunky and outdated. We’ve entertained other tax software, but at the end of the day, tax is tax, software is software (we are experiencing some limitations with 60+ rental activities, 60+ K-1s, and / or 10+ states).

SurePrep which was recently purchased by Thompson Reuters does our electronic tax binders. It also scans a 144-page brokerage statement and finds that pesky foreign dividends breakout on page 87, and plops all this into the tax return. Oh, and it does just fine with all the other typical tax documents too. OCR, or optical character recognition, is one thing, but SurePrep actually deconstructs the PDF directly looking for the data (ie, fewer typos).

CanopyTax or simply Canopy is our workflow software. We chose them for two big reasons- it captures all email to and from the client, so if Bob emails the client and Suzie emails the client, Naomio can also see what was communicated before she does or asks for something silly. The other thing Canopy does is directly pull transcripts from the IRS. Yeah, that’s pretty cool.

CanopyTax or simply Canopy is our workflow software. We chose them for two big reasons- it captures all email to and from the client, so if Bob emails the client and Suzie emails the client, Naomio can also see what was communicated before she does or asks for something silly. The other thing Canopy does is directly pull transcripts from the IRS. Yeah, that’s pretty cool.

Sharefile handles all our client portals and document management including deliverables to the client.

Jotform is our provider for secure online forms.

ADP is our payroll processor. We currently process payroll for over 900 businesses.

QuickBooks Online and REIHub (for our rental propery owners) are the only accounting platforms that we support. No, we will not use Logmein or some other nonsense screenshare so you can continue to use Desktop from 2012. Yuck! We also don’t accept QB data files for tax return preparation. We will happily download financial statements from QBO, Xero, Waveapps, Freshbooks and the like… but our Accounting Services Team only supports QBO and REIHub.

For internal support as well as professional development, we have the following committees and subject matter experts (SMEs)-

Our ideal candidate… a successful WCG team member… is-

Everyone at WCG has these traits, or at least fakes them. We are bit nutty, Yes, but we unfortunately expect everyone who joins our team to be similar in most ways. See Human Resources below for more descriptors.

The following benefits are offered by WCG CPAs & Advisors for full-time, permanent employees:

The following benefits are offered by WCG CPAs & Advisors for full-time, permanent employees:

WCG is full of young people in the family building phase of their lives. 67% or so of our team are women with 67% of our team being under the age of 40. Our short-term disability policy includes up to 60% of your weekly salary to a maximum of $1,730 per week for 6-8 weeks depending on the type of delivery. This is usually augmented with certain state programs such as Colorado’s FAMLI act which pays a portion for a longer period of time (and then our family leave “backfills” up to $1,730 per week). Also, depending on years of service, WCG will augment this benefit with additional salary to make you whole. Please refer to our Associate Handbook. Keep in mind that all of our partners except one are women, and those are all mothers.

Each family leave plan is unique. You meet with Emily, who heads up our Human Resources and is also a mother, and design the plan- expected last day, expected return to work day, workload transition and capacity upon returning, what you need from the team before, during and after, and all the good stuff in between. From there, and given our flexible work schedule attitude, child care and related matters are blended with your daily workloads. You drop off, and other parent picks up? You do both? No worries! As mentioned elsewhere, the team does not care in the manner in which you get your work done, as long as it gets done. Whether you are grocery shopping or sitting in carpool, you might answer the phone with a “hey, I’m not in front of my computer, what’s up?” and that is perfectly A-OK.

We are extremely sensitive to the challenges of having children and raising them to be future tax and accounting professionals, or professional athletes, whichever is easier.

Oh boy, there’s that phrase again. Here we go, and some of this might be repetitive-

As mentioned elsewhere, all new tax team members must either be credentialed (CPA or EA), be on the CPA track or pass the Enrolled Agent exams within 6 months of joining the team. We offer expense reimbursements and bonus incentives for obtaining your CPA or EA credential. Once credentialed, we have a firmwide account with Sequoia CPE for earning education credits including ethics. Sequoia is nice because it is test-based, and you knock out a bunch of hours in short order.

WCG also reimburses you for your annual state CPA licensure fees for one state. However, we don’t reimburse for individual AICPA membership and related organizations. That kind of stuff gets out of control quickly (and we are members of AICPA, NATP and NACVA as a firm).

We continue to look for like-minded employees to be solid contributors to our team. We can teach you anything… but we cannot infuse certain traits into cemented personalities. So… in addition to the accountant job descriptions above we are looking for-

We do not believe the customer is always right. They can be difficult, they can be jerks and they can be wrong. On the other hand, we need to make every client feel like they are the only client. You must be helpful. You must be able to shift your approach when explaining something the client doesn’t understand.

Must have excellent organizational skills and have an attention to detail. No kidding.

We are not dull or stuffy. We throwback beers and cocktails at 4:05PM on Thursdays during tax season since drinking before 4:00PM is considered irresponsible by Tina. Check out our Social Hour page. We take the work that we do seriously, but we don’t take ourselves seriously.

We are not dull or stuffy. We throwback beers and cocktails at 4:05PM on Thursdays during tax season since drinking before 4:00PM is considered irresponsible by Tina. Check out our Social Hour page. We take the work that we do seriously, but we don’t take ourselves seriously.

You are likely going to hear some swearing and an occasional F-bomb. If that cuts across your grain, we understand but we might not be your tribe. We are not just professional, we are professional AF.

Given the size of our staff and the demands of our wonderful clients, our pace is blazing. If you approach everything with the same level of energy, this isn’t the firm for you. Yes, we mess around and have a laugh. No, we are not all business all the time. But… when there is a pile of crud on your desk (or more appropriately your workflow dashboard), you need to find that extra gear and get a move on while maintaining accuracy, customer service and work attitude. Therefore, you must be able to hustle when you can and slow it down when required. Throw in your air pods and hunker down.

You must be able to take the bad with the good. Accounting is inherently a negative business since all we do is look for things that are wrong (the client seems to take the same approach, don’t they?). If you are looking for only kudos, hugs and rainbows, then this will be a tough environment. If you are a professional accountant looking to improve your craft, then you’ll fit right in. We want to do a better job tomorrow than we did today.

And Yes, we provide all kinds of feedback through our RAVEs (Recognizing A Valued Employee), Wall of Fame (client kudos) and positive Google, Yelp and SurveyMonkey responses. You are going to stumble because… well… you are human. We’ll pick you up, give you some pointers on avoiding the pitfall and move along.

We’ve created training manuals, procedures and checklists. While we leave room for anomalies and outliers, we need you to embrace the concept of standard operating procedures.

You must be able to mentor others on your team and critique their work product. If you don’t like having difficult conversations and prefer to hope things change naturally, working alongside our team will be tough. Heroes run towards the danger and professionals, including accountants, run towards the problem. Perhaps accountants only walk briskly towards the problem, but you get the idea.

Hopefully this didn’t blow you up too badly.

Here is the step by step process-

Once an offer is accepted, then there might be a lot of radio silence depending on start date. As things get closer, we order a background check. For remote positions, we also do a tech survey and see what things you need, and start to discuss travel plans.

About 30 days before your start date, training materials and a schedule is presented.

And away we go!

Apply online to join the team- answer some questions and upload a resume!

We are located at the entrance of the Flying Horse community on the southwest corner of Highway 83 and Flying Horse Club Drive. We about 35 minutes from south Denver and about 25 minutes from downtown Colorado Springs.

2393 Flying Horse Club Drive

Colorado Springs, CO 80921

2393 Flying Horse Club Dr, Colorado Springs, CO 80921

Do you want a tour of our office space? Sure, why not! We are super proud of our space especially the social lounge, so please forgive us if we brag it up a bit.

Thank you in advance for your interest in WCG. We truly wish you the best in your search and in your career!

Take a tour of WCG.

WCG is a tax consultation and business advisory firm in beautiful Colorado Springs and bustling Denver serving clients around the globe. Over 80% of our clients are outside of Colorado!

Table Of Contents

Tax planning season is here! Let's schedule a time to review tax reduction strategies and generate a mock tax return.

Tired of maintaining your own books? Seems like a chore to offload?

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.