Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Hey - Our site just had a makeover and we are sorting through the hiccups!

Hey - Our site just had a makeover and we are sorting through the hiccups!

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Posted Sunday, January 19, 2025

Table Of Contents

| LLC | Corporation | S Corporation | |

| Formation | Articles of Formation | Articles of Incorporation | NA |

| Internal Governance | Operating Agreement | Bylaws, Shareholder Agreement | Depends |

| Owners Called | Members | Shareholders | Depends (Shareholders) |

| Owners Own | Interest | Shares | Depends |

| Owners Take | Owner Draws | Owner Draws | Shareholder Distributions |

| Federal Tax Rate | 15.3% + Individual Tax Rate | 21% + Dividend Tax Rate | Payroll Tax + Individual Tax Rate |

Some notables-

Under S corporation, the “depends” is double-talk that we accountants love to use for everything. However, in this case it is quite simple. Since an S corporation is only a tax election, nothing changes from an internal governance and ownership perspective. If you have an LLC taxed as an S Corp, then you will have an Operating Agreement and you will own an interest.

If you have a corporation taxed as an S Corp, then you’ll have Bylaws (and perhaps a Shareholder Agreement) and you will own shares. However, in accounting parlance, we will commonly refer to owners of an LLC taxed as an S corporation as shareholders from a tax return perspective, but they are truly members.

The 15.3% under LLC represents self-employment taxes, which are the same as Social Security and Medicare taxes.

C corporations remain tax inefficient and S corporations remain a good tool for overall tax efficiency. We’ll discuss further in a bit.

Why does an S Corp election exist? Let’s run through some history to better understand. Back in the day, like way back, only C corporations existed. No LLCs. No S corporation elections. So, as a business startup you either were a sole proprietorship or a C corporation. A sole proprietorships does not shield the owner from liability while a corporation does, but a traditional corporation also has two layers of taxes (income tax on the corporation, and dividend tax on the shareholders). Like a Presidential election, it was a choice between two evils. Speaking of Presidents…

In 1958, Congress alongside President Dwight Eisenhower created the S corporation election which allows for liability protection of the underlying corporation entity yet only a single layer of taxation (ergo, a pass-thru tax effect). However, in 1958 the only entity type (generally) was the C corporation. As such we had sole proprietors, C corporations and C corporations being taxed as an S corporation as our choices. This spawned the S corporation vs C corporation debate directly.

More history! In 1977, Wyoming was the first state to recognize and authorize the limited liability company but it took the IRS over 11 years to allow pass-thru tax treatment. Keep in mind that business entities are governed (bestowed) by state governments, not the federal government or the IRS.

According to a 2014 article from the Tax Foundation, the number of C corporations has shrunk from their height around 1987 while S Corps and partnerships have steadily grown during the same time. As of 2014, there were 23 million sole proprietorships / single-member LLCs, 7.4 million S corporations /partnerships and 1.7 million traditional C corporations.

This follows IRS data as well. In 2003, 1.9 million corporation (Form 1120) tax returns were filed but in 2013 this number was 1.6 million. Compare this to 2014 where over 4.3 million S corporation (Form 1120S) tax returns were filed. Of this 4.3 million, 95% of the S Corps had 3 or fewer shareholders, and 64% had just 1 shareholder. The little guy was getting the best of both worlds… Dwight would have been proud!

Sidebar: President Dwight Eisenhower also signed the Civil Rights Act (1957) and mobilized federal troops to Little Rock to enforce the provisions, championed the Interstate Highway System (1956), created NASA (1957) including nuclear deterrence, ended McCarthyism through executive order and was a 5-star General from WWII. S corporation elections seem a bit silly in lieu of all this. Oh, and Coloradans cannot forget about the Eisenhower tunnel that goes under Loveland Pass (and the continental divide) allowing I-70 to continue from Denver to the west due largely in part to Interstate Highway System funds (thanks again Dwight!). The east bore is called the Johnson tunnel (Edwin Johnson was a U.S. Senator and Governor of Colorado). Can I have tunnels for $400 please Alex?

Back to business. The 2013 and 2014 is the most current IRS data. Have things changed with the passage of the Tax Cuts and Jobs Act of 2017, especially with the 21% corporation tax rate? We say No. The tax effects of a S corporation vs C corporation simply don’t support a move away from S Corps. We’ll illustrate that in a bit.

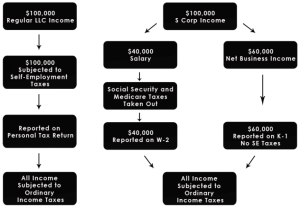

Why does an S Corp election exist? Well, we explained that earlier with a brief history lesson. More importantly, why does an S election exist in today’s climate? Easy! The near singular answer is the reduction of self-employment taxes. As mentioned everywhere on our website and our book, a garden-variety LLC that earns $100,000 after expenses could save $8,000 to $9,000 in taxes annually by leveraging the S corporation election. How?

In other words we parse away a chunk of business income and only subject it to income taxes while the rest is paid as a salary to the shareholders and is taxed with Social Security, Medicare and income taxes.

Naturally you want to keep your salary as low as possible to ultimately keep your overall S Corp taxes reduced. However, the IRS wants you to pay a reasonable salary which is a super squishy and grey number. And, you might want to bump up salaries to allow for larger 401k contributions and to also optimize your Section 199A deduction.

Click on the buttons below for more information on this… we don’t want to sidebar too deep within this article of S Corporations vs C corporations.

A traditional C corporation is not all bad. First, let’s run through the problems to help better understand the S corporation vs. C corporation debate. We have a video on C Corps which goes through a lot of this, including a PowerBore slide deck. Here we go:

C corporations remain tax inefficient. The primary motivation is the seemingly sexy 21% tax rate for C corporations and while this might be lower than some taxpayer’s marginal rate, this is a sucker hole for business owners for two painfully obvious reasons. First, your marginal rate might be 24% or 26%, but your effective tax rate (or blended tax rate) is much lower. We’ll show you! Not to worry.

The C Corporation is not as popular as it once was namely because the LLC has taken over as the go-to entity. But, in some cases you might need to create a Corporation, especially if you are a professional such as a attorney, doctor, engineer or lowly accountant.

Second, there is a little thing called double taxation, where the C corporation pays a tax and then the shareholders pay a dividend tax on the money that is distributed. And… if you think you’re a smarty-pants and say, “Yeah, but, I’ll just keep all my money in the C corporation for a rainy day and lower tax rates,” there is another little thing called accumulated earnings tax.

Let’s illustrate this with some good old-fashioned devils buried deep into the details. Assumptions include:

Buckle up buttercup ’cause here we go:

| S Corp Income | 100,000 | 200,000 | 300,000 |

| Salary | 40,000 | 80,000 | 120,000 |

| Payroll Tax | 6,120 | 12,240 | 18,360 |

| Income Tax | 6,980 | 24,150 | 44,266 |

| Total S Corp Taxes | 13,100 | 36,390 | 62,626 |

| C Corp Income | 100,000 | 200,000 | 300,000 |

| C Corp Tax | 21,000 | 42,000 | 63,000 |

| Dividends | 79,000 | 158,000 | 237,000 |

| Dividend Tax | 23,700 | 44,556 | |

| Total C Corp Taxes | 21,000 | 65,700 | 107,556 |

| Effective S Tax Rate | 13.1% | 18.2% | 20.9% |

| Effective C Tax Rate | 21.0% | 32.9% | 35.9% |

| Delta (extra tax because of C Corp) | 7.9% | 14.7% | 15.0% |

As you can see, a C Corp does not make sense after you add in capital gains tax on the dividends. This in turn makes sense — the lawmakers didn’t set out to kill S corporations. They set out to give every business owner a tax break. Gosh, half of Congress (535 doesn’t divide evenly, we get it) probably run S corporations on the side for their consulting and speaking gigs. C Corps remain a bad idea for tax efficiency.

Also note the effective tax rate (or labeled as tax “pain”) for the S corporation owner. At $100,000 in net business income, the total tax pain including payroll taxes is 13.1%, and at $200,000 it is only 18.2%. This is still well below the C corporation tax rate of 21%.

And! There’s more! C corporations do not enjoy the 20% Section 199A deduction either. Pile that onto the numbers above for even more reasons.

So, please pump the brakes on the “I wanna dump my S Corp for the magical tax arbitrage offered by a C Corp” nonsense. Wow, that was harsh. We did tell you to buckle up, but then we offended you by calling you buttercup. Safety with an insult.

As business entity types go, C corporations are not all bad. Here are some benefits:

One of the benefits is you keep income off your individual tax return (Form 1040). For example, if you had an LLC whose business transactions were typically reported on Schedule C of Form 1040, if you converted this LLC to a corporation, the income is contained in the corporate tax return (Form 1120). If you pay a salary or pay out dividends, that changes things. Why would you want to keep income off your individual tax return? Perhaps you have Social Security or disability benefits that might disappear or become taxable. Perhaps you are running away from some bad guys who are collecting on a debt. Maybe you use the C Corp to pay for your mistress of her expensive tastes. All kinds of reasons!

Having your employees own member interest in an LLC or S Corp can be tricky since each one would get a K-1 regardless if their interest was economic only (profits) or equity (ownership). You could get around this by having your employees own the right to a portion of the business which triggers into equity upon a certain event such as transfer of ownership or control. In other words, Employee A has the right to 2% ownership upon sale, partial or wholesale. This works! But, it can also be messy and hard to explain. WCG converted to a C corporation for this reason; we are selling bits and pieces of our business to partners and employees, and shares in a corporation makes more sense. Each partner is paid a fee for service directly from the corporation.

This is akin to a barrel of oil. You can either own the right to the barrel of oil, or the barrel of oil itself.

If you are a professional such as an attorney, accountant, medical doctor or engineer, you typically have to register as a professional entity, either a Professional LLC (PLLC) or a Professional Corporation (PC). However, some states, such as California, does not recognize PLLC and as such you must create a corporate that is deemed to be a PC. And in those cases, we typically recommend an immediate S corporation election to have your PC taxed as an S Corp (see crummy C Corp tax rates above).

Colorado and Texas, among several other states, allow for a PLLC or a PC, it’s up to you. WCG is a PC. We don’t want to digress too much here, since this article is about S corporations vs. C corporations. However, it’s important to understand that at times the conversation is moot since you must be a corporation, and the only remaining question is whether to elect S corporation status.

Who wants to pick on California some more? We do.

California allows corporate officers to opt-out of State Disability Insurance (SDI). SDI is California’s version of FMLA, and some business owners want to go on leave for new babies, etc. However, if your baby-making days are clearly in the rearview mirror, then perhaps you want to opt out of SDI. This is easily done, but only for corporate officers, and No, members of an LLC are not considered corporate officers since LLCs are companies not corporations. All in all, WCG creates far more corporations in California for this reason and for the PC designation reason.

If your estate plan attorney or another attorney recommends a corporation, ask the hard questions so you understand why. There might be good reasons to do so, and we leave room for attorneys to be right some of the time.

In summary, unless you fit the buckets above, then you should be an LLC or a C corporation taxed as an S corporation if business incomes warrant.

A common complaint from those who own their own business is self-employment tax. As alluded to earlier, S corporations were originally built to help owners have the best of both worlds; liability protection and pass-thru taxation. Today, the primary reason is self-employment taxes.

Can you avoid, reduce, eliminate or lower your self-employment taxes or SE taxes? Yes, to a large extent actually, but it takes some effort (like a tiny, tiny amount) and an S Corp election.

If you own a business as a garden variety single-member LLC (one owner), your business income will be reported on your personal tax return under Schedule C and is subject to self-employment tax (currently 15.3%) and ordinary income tax. The same is true for other business entity types that have not election S corporation tax status such as a sole proprietor and partnerships. So, you could easily pay an average of 40% (15.3% in SE taxes + 25% in income taxes, blended) on all your net business income in federal and state taxes. Perhaps more… Wow!

Income taxes is largely a sunk cost. You can reduce it by having less revenue, spending more money on deductible things and / or earning some of the various business tax credits.

If you own an LLC and have elected to be treated as an S corporation for taxation, the business now files a corporate tax return on Form 1120S. What’s the big deal? Before we get into that, let’s look at some quick numbers. These are based on using a salary of 40% of net business income for incomes up to $500,000 and then decreased incrementally to 30% for the millionaire at $2,500,000 below (real case actually).

| Income | Total SE Tax | Salary | Total Payroll Tax | Delta | Delta% |

| 30,000 | 4,239 | 12,000 | 1,836 | 2,403 | 8.0% |

| 50,000 | 7,065 | 20,000 | 3,060 | 4,005 | 8.0% |

| 75,000 | 10,597 | 30,000 | 4,590 | 6,007 | 8.0% |

| 100,000 | 14,130 | 40,000 | 6,120 | 8,010 | 8.0% |

| 150,000 | 18,711 | 60,000 | 9,180 | 9,531 | 6.4% |

| 200,000 | 20,050 | 80,000 | 12,240 | 7,810 | 3.9% |

| 300,000 | 22,972 | 120,000 | 18,174 | 4,798 | 1.6% |

| 500,000 | 29,991 | 200,000 | 20,494 | 9,497 | 1.9% |

| 750,000 | 38,764 | 262,500 | 22,307 | 16,457 | 2.2% |

| 1,000,000 | 47,537 | 350,000 | 24,844 | 22,693 | 2.3% |

| 2,000,000 | 82,630 | 600,000 | 32,094 | 50,536 | 2.5% |

| 2,500,000 | 100,177 | 750,000 | 36,444 | 63,733 | 2.5% |

Don’t get too hung up on the drop in percentages. Focus on the overall hard dollar amount. Notice the sweet spot at $100,000 to $150,000 (yes, it dips at $300k due to Social Security limits). Also consider that if you run self-employed health insurance through the business (and you should), savings jumps up even more. Why? It has to do with the Social Security wage limit ($137,700 for the 2020 tax year) and we expand on this in our book titled Taxpayer’s Comprehensive Guide to LLCs and S Corps.

S Corp taxes are basically the payroll taxes paid on shareholder salaries plus the ordinary income taxes for each shareholder.

There is a cost to being an S corporation of course; all that glitters is only partially gold. Additional tax preparation fees for the corporate tax return and payroll processing are the two biggies. Still not convinced? No problem… please check out Line 4 from Schedule 2 on your Form 1040 tax return. This number reflects the self-employment taxes paid on your business income. We want to reduce this by 60 to 65% and we assume you do too!

Check out these S Corp resources as well:

Please visit the following buttons for additional resources such as business structure and formation, business support services and business entity tax preparation.

Shameless self-promotion alert! We have written a dorky book called Taxpayer’s Comprehensive Guide to LLCs and S Corps. Over 300 pages of pure pleasure. It is available online, for free, within our KB articles, or from Amazon and other less than average retailers. Please click on the button below for more information-

Learn the latest tax updates and insights for small business owners in the 2023-2024 Edition.

WCG is a tax and business consulting firm in Colorado Springs, Colorado but we serve clients all over the world… primarily in California, Texas and the east coast which coincidentally is where the nation’s GDP is generated.

Table Of Contents

Tax planning season is here! Let's schedule a time to review tax reduction strategies and generate a mock tax return.

Tired of maintaining your own books? Seems like a chore to offload?

Did you want to chat about this? Do you have any questions for us? Let’s chat!

The tax advisors, business consultants and rental property experts at WCG CPAs & Advisors are not salespeople; we are not putting lipstick on a pig expecting you to love it. Our job remains being professionally detached, giving you information and letting you decide within our ethical guidelines and your risk profiles.

We see far too many crazy schemes and half-baked ideas from attorneys and wealth managers. In some cases, they are good ideas. In most cases, all the entities, layering and mixed ownership is only the illusion of precision. As Chris Rock says, just because you can drive your car with your feet doesn’t make it a good idea. In other words, let’s not automatically convert “you can” into “you must.”

Let’s chat so you can be smart about it.

We typically schedule a 20-minute complimentary quick chat with one of our Partners or our amazing Senior Tax Professionals to determine if we are a good fit for each other, and how an engagement with our team looks. Tax returns only? Business advisory? Tax strategy and planning? Rental property support?

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.