Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Table Of Contents

Posted Saturday, August 3, 2024

While discussion with a qualified estate planning attorney is essential when using a Trust, here are some basics about Trusts to better understand how they mesh with your business world.

Trusts do two things very well. First, they usually help bypass probate. If you own property in three different states, then probate must be opened and closed in all states. The process is long. It is expensive. It is public.

Second, they help you, the dead guy, dictate policy from the grave. If you want to ruin a 30-year old’s life, give Junior a million dollars. A Trust can dole out money according to a schedule. Special needs kid? Drug addict? Nut-job son-in-law? A Trust can protect your interests long after you’re cold.

Trusts might also protect your children. Here’s an example. You die. Your wife wears a short dress and heels to the funeral (naturally), and waits the obligatory 4-6 weeks before dating again. She gets married because your dying words were, “I want you to be happy.” She lives another decade and then dies suddenly. Now this dude whom you never met has all the money and doesn’t care about your kids. Wonderful.

The only difference for women is that men would only wait 2-3 weeks to start dating, but the rest remains unchanged.

Irrevocable Trusts are the roach motel- assets can check in, but they can’t check out. The grantor does not have any authority over the trust; only the trustee does. The trustee cannot be you, the grantor. The trustee could be your best friend but cannot be influenced by you. The trustee must make decisions with the Trust’s interests in mind as a fiduciary.

Some people try to install poison pills in an Irrevocable Trust where if certain events happen, the assets revert back to the grantor. Be careful on this. The IRS ruled in Private Letter Ruling 201426014 that the,

provision in trust that provides that, in the event that both the children are no longer serving as members of the Distribution Committee or if there are fewer than two serving members, the trust property will be distributed to the grantor, and the trust shall terminate, constitutes a reversionary interest under Code Sec. 673.

This is one example of a poison pill that backfired. This was a Revocable / Living Trust disguised as Irrevocable.

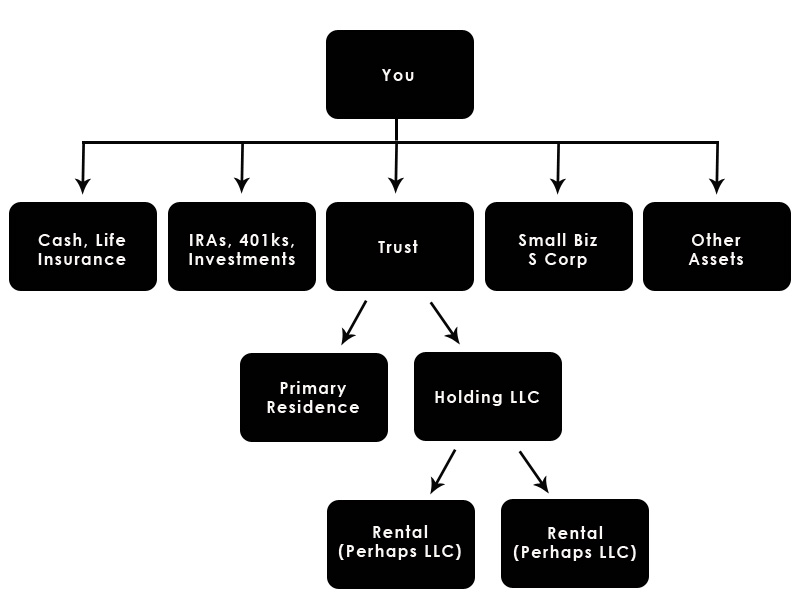

Those items that have built in beneficiaries such as life insurance and investment accounts might be placed in a Trust, but they do not have to be since these assets bypass probate automagically. However, if you want these proceeds metered out according to a schedule, then the Trust needs to be the beneficiary. Get some planning!

Litigious assets are usually encapsulated in an LLC prior to being placed in a Trust. Automobiles are an example of litigious assets, but they are usually directly owned by an individual. Real property such as rental real estate is another great example. But what if you wanted to have your rentals pass through to your estate and skip probate?

Having said all this, many business and corporate law attorneys will suggest only using an LLC with an Operating Agreement, and not rely on a Trust. The new generation of estate planning attorneys are also abandoning the use of Trusts. Some believe that Trusts are being oversold, and while they are necessary, the ideal situations are fewer and farther between.