Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Table Of Contents

Posted Sunday, May 25, 2025

The following is a list of common rental property tax deductions. Some of these are short and sweet while others have an entire section to themselves (such as travel). Schedule E on your Form 1040 individual tax return and Form 8825 on your Form 1065 partnership tax return have a similar list. WCG CPAs & Advisors has an Excel template affectionately referred to as the Simplified Rental Operations worksheet, or the “SRO” for short-

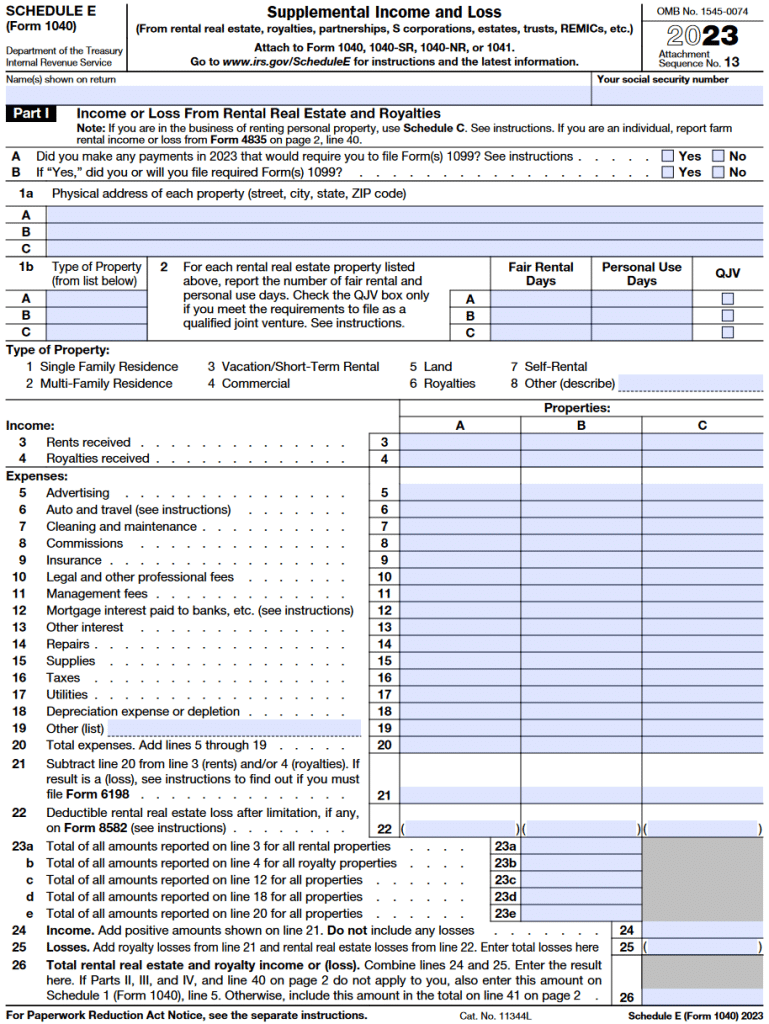

The following has a sample of Schedule E where you report rental property income and expenses-

Here we go-

Here we go-

These expenses include Airbnb or VRBO setup and recurring fees including staging pictures, print media and signage. You might list these as commissions, however, usually commissions are based on a completed transaction such as placing a tenant or scheduling a guest. Then again, we are splitting hairs.

A property manager might have start-up or boot-up fees as well. You might also use AirDNA to collect market data for your advertising and marketing plan. Multiple listing services (MLS), including Apartment Finder, Rent.com and the like are also common advertising expenses for rental properties.

Keep in mind the vacation home rules where certain expenses might be fully deductible even if you trip the vacation home trigger. Advertising and marketing is usually considered one of those expenses that are not prorated or split between rental expenses and personal expenses.

Automobile expenses are generally limited to three situations-

If you refer to the sample Schedule E form, you’ll see that Line 6 reads auto and travel expense. According to the IRS instructions, this line includes auto, travel and meals. However, it is also common practice to record travel such as airfare and lodging including meals on Line 19.

See our automobile deductions with rentals section and rental property meals section for more information.

This rental expense category seems obvious, but the word maintenance can be confusing. Is changing a light bulb considered maintenance? Likely. Is painting a wall that is scuffed considered maintenance, or is it a repair?

Maintenance is work performed to keep the rental property functioning correctly. Swapping out a light bulb makes sense. Replacing an HVAC filter or re-charging the air conditioning system makes sense as maintenance. Conversely, a repair usually resolves damage. In our scuffed wall example above, this would likely be a repair.

Let’s not forget the root word in maintenance is maintain. Ok, we really beat that up, didn’t we?

Your cell phone is a commonly overlooked rental tax deduction, but how much do you deduct? A cell phone is what we call a mixed-use expense between business and personal. As such, you use personal funds to pay for the expense, and then assign a business use percentage to calculate the tax deduction.

Neat, how do you calculate business or rental property use? Are you tracking each minute spent? Back in the day, the answer was Yes. However, today any consistent and reasonable method is acceptable.

A single long-term rental property might be 5%. However, that same rental property where you turned over a tenant and several minor repairs were coordinated with contractors, your business use might jump to 15%.

A short-term rental that has one busy season might be 15%. Two busy seasons, such as a ski condo, might be 25%.

You also have to balance other cell phone demands. If you also run a separate business including managing rental properties, the rental portion might be less.

We could go on and on like a Journey song. The big takeaway is to be reasonable. The only time your cell phone could be 100% is if you had a separate and dedicated cell phone only for the rental property. Frankly, this is not a bad idea, so your guests, contractors and other similar people don’t have your personal cell phone number.

Later in this section we discuss management fees, so it is important to draw a distinction between commissions and management fees here. Commissions in most walks of life are based on a singular transaction. A commission might be a property manager charging a leasing fee for finding a tenant. They might also charge a monthly fee for managing the property including the tenant relationship. This second example would be a management fee.

Another way to look at this- a commission is an expense paid to facilitate a transaction. A management fee is an ongoing expense to supervise and support a process or relationship.

We have several other sections that discuss depreciation including accelerated and bonus depreciation. Here is a mini table of contents-

Amortization is usually reserved for intangible assets, and for rental properties this is usually loan costs.

A home office deduction in connection to managing your rental property or series of real estate activities is tricky but it is also super beneficial for travel expenses. See our home office deduction section for more information. Additionally, see our allocation of general expenses as well.

Easy, we’ll move along.

Another easy one, but before we move along, at times a real estate investor or rental property owner will have commercial umbrella insurance to provide another layer of coverage to your liability onion. For example, you might have $300,000 in bodily injury coverage, but would like to increase this so you add a $3M umbrella policy. However, this second policy might start at $500,000 for bodily injury, so you will need to increase the limit of the underlying or primary insurance policy to prevent a gap in coverage.

We discuss how to allocate or apportion umbrella premiums across multiple rentals in our allocation of general expenses section.

Yes, plural. There are two types of internet expenses. First, you have a short-term rental and you customarily provide internet service for your guests and tenants. Second, you use your home internet service in part to manage your rental properties and real estate investments.

The first example is easy, whereas the second example requires a business use calculation similar to cell phone and home office listed previously. WCG CPAs & Advisors uses anywhere from 5% to 80% of your home internet expenses as associated with rental property management or business use, with most owners settling in between 5% and 30% depending the size of their kingdom.

Legal and professional fees include what you would expect such as eviction assistance or reviewing a lease. However, many rental property owners neglect to allocate tax return preparation and related expenses. Let’s say your real estate buddies at WCG CPAs & Advisors prepare your tax returns. The following year, we would allocate a portion of the fee to each rental property. For example, if your tax return preparation fee was $900, perhaps $200 of this is associated with the rental activities. Sure, it is a relatively small amount, but at a 29% combined marginal tax rate between federal and state, this might buy you a nice lunch for zero effort. Free food has no calories.

We won’t spend too much time on licenses and permits, but be aware of the insidious application, permit and registration fees that a city or other authority might charge you for the privilege of being a landlord.

As we discussed earlier, management fees are those expenses for the continued and recurring management of the property including tenant relations. These are contrasted with commissions which are more transactional.

Like advertising and marketing, management fees are typically assumed to be 100% related to the rental activity when vacation home rules apply or if you convert a primary residence or second home into a rental.

We don’t want to stuff a bunch of expenses into management fees. The IRS reportedly uses management fees as a proxy of sorts to trigger the inquiry of passive versus material participation. In other words, high management fees suggest a more passive role for the rental property owner. As such, software and related expenses should be reported elsewhere leaving management fees being limited to guest and tenant placement fees or commissions only.

Mortgage interest seems easy enough but when you borrow against your primary residence or another rental property, interest tracing rules will apply. See the mortgage interest tracing section.

Additionally, you might have interest associated with a credit card or other borrowing scenario.

Oh boy, we discuss this in a zillion different places throughout our book. Here is a mini table of contents-

Applications and subscriptions such as REIHub, Stessa, QuickBooks Online, Airbnb, VRBO, AirDNA, and the myriad of other support tools are ordinary and necessary expenses for your rental property.

Supplies include cleaning supplies, coffee pods and creamers, shampoo and soap, and other similar consumables. Furnishings include dishes, pots and pans, kitchenware, linens, towels, decorations and furniture. Be aware of the $2,500 de minimis safe harbor where a piece of furniture that exceeds this amount must be capitalized as an asset and depreciated over time or Section 179 expensed. What is tricky is the dining room table that costs $4,000 total, but is made up of a table and six chairs where the invoice has each item listed separately.

The two most common taxes for rental property owners are property tax, and sales, occupancy or innkeeper tax depending on your geographic location and local nomenclature. Historically, Airbnb, VRBO and the like made it challenging for landlords to be compliant. Today, they do a much better job helping you collect and remit the proper guest-related taxes.

Ah, another can of worms. We have two sections for your reading enjoyment. First, rental property travel deductions, and second, rental property meals.

Easy, right? At times landlords will charge for utilities on top of the base rent. In these cases, you should still report all monies collected as top line rental revenue, and then deduct utilities as you pay them although some might be reimbursed. This allows for basic reconciliation where all money collected is either rent or a deposit, and money spent is either loan payments or expenses (yes, this is overly simplified, but you get the premise).

Rental property owners routinely try to deduct lost rent, or the rent they didn’t collect because a tenant skipped out on the last month or broke the lease. This is like a business owner not getting paid on an invoice. Most rental property owners are cash-based taxpayers which means you recognize revenue when you receive cash. As such, if you don’t receive a rent payment then you are not recognizing revenue, and that in itself is the tax benefit.

Bad debts, including accounting for lost rent, only works in an accrual-based accounting world where you recognize income as you invoice the customer or tenant. Later, the invoice does not get paid although you recognized it as revenue originally. A bad debt expense is then used to offset this phantom income, and when combined the result is usually netted to zero which is the same effect as the first example in a cash-based world.

See our idle property versus vacant rental property section on page 338 for several issues during vacancy-

What about mortgage interest and property taxes while you are between tenants? If your rental property is not ready and available for rent, and in line with IRS Revenue Ruling 99-23 and IRC Section 195, these expenses are not considered operating expenses and therefore are not deductible.

You could possibly deduct the mortgage interest as a second home, but further discussion is required. You might be able to deduct the property taxes subject to the current $10,000 combined state and local tax limitations on Schedule A of your Form 1040 tax return.

What’s the answer? The answer is to make that rental property ready and available for rent as soon as possible.

You purchase a rental property on July 1, and it is generally ready to rent. Nothing says you must immediately pay a bunch of money for fancy pictures, staging and VRBO listings. The rental property is available with nothing more than your willingness and a habitable dwelling. Then you can start shooting the money canon.

Nothing says you must align your rent fee with market conditions; for example, you buy a ski condo on September 1. No one is going to rent your condo until at least Thanksgiving, but it is available to rent, and as such you are considered operating.

Nothing says you cannot have the rental property available for rent, and simultaneously be painting various bedrooms and walls waiting for your next tenant or guest.

Know the rules. Assert your facts accordingly. Keep your rental property ready and available for rent.

The IRS in Topic 414, rental income and expenses, spells this out nicely-

Security deposits – Don’t include a security deposit in your income if you may be required to return it to the tenant at the end of the lease. If you keep part or all of the security deposit because the tenant breaks the lease by vacating the property early, include the amount you keep in your income in that year. If you keep part or all of the security deposit because the tenant damaged the property and you must make repairs, include the amount you keep in that year if your practice is to deduct the cost of repairs as expenses. To the extent the security deposit reimburses those expenses, don’t include the amount in income if your practice isn’t to deduct the cost of repairs as expenses. If a security deposit amount is to be used as the tenant’s final month’s rent, it is advance rent that you include as income when you receive it, rather than when you apply it to the last month’s rent.

Takeaways-

You purchase a laptop to help manage your rental properties. To say it is 100% business use is likely a stretch, but we can agree that it is more than 0%. Similar to cell phone, home office, internet and related expenses, or what business owners would call mixed-use or Accountable Plan expenses, small equipment purchases receive the same analysis- how much is personal and how much is related to rental property management.