Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Hey - Our site just had a makeover and we are sorting through the hiccups!

Hey - Our site just had a makeover and we are sorting through the hiccups!

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Posted Wednesday, April 24, 2024

Table Of Contents

This is long. No way around it. Grab some coffee, put the phone in a different room, turn off notifications, and please give us 15 minutes of your time. This checklist is more geared toward individuals (Form 1040). Partnership (Form 1065) and Corporate (Form 1120 and Form 1120S) tax returns have a separate business tax return review checklist. Click on the button below:

This is long. No way around it. Grab some coffee, put the phone in a different room, turn off notifications, and please give us 15 minutes of your time. This checklist is more geared toward individuals (Form 1040). Partnership (Form 1065) and Corporate (Form 1120 and Form 1120S) tax returns have a separate business tax return review checklist. Click on the button below:

Guide to filing your business tax returns, scheduling reviews, eFile, and making payments.

Reviewing and understanding your individual tax returns are important things, and with our virtual tax preparation world, sitting down with your CPA or tax accountant to review your tax return is a challenge. Today we rely on emails, telephone calls and video-conferencing (Teams). Also, people are busy with life on life’s terms. So, we developed this flowchart to help you review and understand your tax returns, and know the process of approving and filing your tax returns.

Rest assured that if you’re concerned or have questions, you can always communicate with us, and we will stop, find some time, and review these items with you. That’s our promise!

Here are the final steps necessary for the filing of your tax returns:

We will now discuss these items in more detail. Yay!

It’s a challenge to know if our clients are done sending us tax documents. So, if you’re still waiting on more tax forms from various sources such as interest (1099-INT), stock sales (1099-B), partnerships (K-1), etc., please let us know. We’ll suspend your tax returns and complete it when we have all the necessary forms.

It’s a challenge to know if our clients are done sending us tax documents. So, if you’re still waiting on more tax forms from various sources such as interest (1099-INT), stock sales (1099-B), partnerships (K-1), etc., please let us know. We’ll suspend your tax returns and complete it when we have all the necessary forms.

Every document and correspondence that was received has been entered into your tax returns, however, scanned documents and internet uploads can still fail everyone. Please follow the steps below to review your tax returns, ensuring there are no omissions or misstatements.

We have uploaded your tax returns to your Sharefile and emailed you two links (your tax return PDF, and your ActionRequired PDF)-

One PDF is the full-blown tax return including state(s) with all the bells and whistles you would expect, plus a lot of stuff you wouldn’t expect. We always give you the complete tax return which goes way beyond the filing copy by providing supporting statements, depreciation schedules, etc.

The other PDF is labeled “ActionRequired” and basically only lists the essential items for filing your tax returns. It includes eFile authorizations, payment vouchers (if necessary) and filing instructions. This file is only about 8-10 pages long, and should be reviewed in its entirety. This is very important because you might be getting a tax refund from the IRS but owe taxes to the state.

Remember, your tax return PDFs are also available in your Sharefile. Use the button below to access:

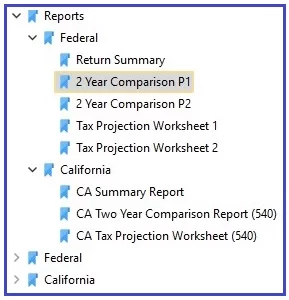

Your tax return PDF is assembled in this order-

Usually one page, directing you to this webpage. Tick.

We cannot file your tax returns unless payment has been made for our tax return preparation fees. However, many tax returns are prepaid either through the business or because of a Business Advisory or Tax Patrol Service engagement. An invoice will be sent through our workflow software called Canopy. You can pay with a credit card or bank draft. You can also access Canopy using the button below.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt it amet, conse ctetur adip iscing elit, sed do eiusmod tempor incididunt ut.

Following the transmittal / cover letter and invoice are detailed filing instructions. Since these are automatically created by our tax software, and we prepare tax returns in all 41 states, there are some blanket comments pertaining to these generated filing instructions. Please read all these pages in the entirety as they discuss signing and dating tax returns, mailing tax returns, payment vouchers and estimated tax payments.

However! Please do NOT mail any tax returns. If this becomes necessary, we will advise you directly and provide you a tax return package complete with tax forms, envelopes, labels, and postage. If the ActionRequired PDF is stating conflicting information, please contact us.

Please spend a little time reviewing the payment vouchers, if applicable. With a lot of local and city tax returns, you might have payments beyond the IRS and state(s).

Shortly after sending an email to you with the tax return PDF links, you will also receive an eFile Authorization email from Canopy in addition to our invoice. This is similar to Docusign. Please do not feel rushed or compelled to complete the eFile Authorization unless you are completely comfortable with your tax returns. A reminder will be sent periodically; please ignore if you are not ready.

This is a summary of your Federal tax return. Please ensure the amounts “feel right.” Also, use this comparison to help understand differences in tax due or tax refunds from previous years. Two-year comparisons are only available if you are a returning tax client or if you provided last year’s tax return (since we input this information into your tax returns for history).

See below for more information on reviewing your tax returns.

This is the beginning of your federal tax return. We are happy to walk through each line and figure of these forms. Happy might be a stretch, but we want you to be 100% comfortable with your tax returns.

If your PDF reader has bookmarks in a pane, you can quickly jump to your state tax returns(s). Otherwise, you’ll need to scroll (sorry).

There are several things we want to bring to your attention.

As mentioned, this compares your current tax return data to your previous tax return data. And in the accounting and engineering world, we are looking for deltas (differences) or changes. And yes, as a part of our internal review process, your tax professionals and managers are likely starting with the Two-Year Comparison as well.

The Two-Year Comparison follows your Tax Return Summary, and is right before the start of Form 1040 (your tax return). In true comparison fashion, these two pages have three columns — where you were, where you are, and the difference. Review these pages, and pay particular attention to these lines:

Income

IncomeLine 1, Household salaries and wages (pre-tax 401k deductions will affect this)

Line 2 and 4, Dividend and interest income

Line 9, Capital gains from selling stocks, securities, property, etc.

Line 11, IRA distributions

Line 13, Rental income

Line 14, Net business income (profits) from S Corps or Partnerships

Line 24, Health insurance deduction

Line 27, IRA deductions

Line 25, Other adjustments (usually HSA)

Line 33, Mortgage interest

Line 34, Charitable donations

Line 41, Qualified Business Income Deduction (QBID)

Line 44, Total taxes being paid (yuck) before credits, withholdings and estimated tax payments

Line 58, Income tax withheld on all W-2s and 1099s (among other weird tax withholdings)

Line 59, Estimated tax payments

Line 67, Tax due or refund (negative amount)

Your effective tax rate (line 70) and marginal tax rate are a true benchmark of your tax consequence. Your marginal tax rate is what your last dollar of income is being taxed at, and your effective rate is the blended rate of all the tax brackets before your marginal tax rate. So, if you have a 24% marginal tax rate you might only have an 17% effective tax rate. As such, if you contributed $100 to charity you would save $24 not $17.

Fun facts-

This is the heart of your tax return. This is where all your schedules and other related items are tabulated, and presented to the IRS in a two-page document. Names and address spelled correctly? Is there a silent Q in Aimee’s name that we overlooked? All dependents listed?

If you have itemized your deductions by exceeding the standard deduction, then you will have a Schedule A that follows your Form 1040. Schedule A details several deductions which are totaled on Line 12 of your Form 1040.

Even if you don’t itemize your deductions, charitable donations are often a separate deduction on your state income tax return. Therefore, please provide this information even if federally it will not matter.

Tax refunds can change from year to year for several reasons! First, your world could substantially change such as new baby, new house, sold house, married, divorced, etc.

Second, your income can change from year to year. Some clients “feel” that their income hasn’t changed, but when W-2s are compared, the change is dramatic.

Third, tax credits could change from year to year due to the whims of Congress and the Treasury Department. Your eligibility for these credits can also change depending on your income and other factors. For example, once your child is 17 years old, their child tax credit goes from $2,000 to $500.

In using the 2-Year Comparison and line numbers above, do those numbers look right? Wages, business income and portfolio income (interest, dividends, capital gains) are the ones to focus on. Compare last year with this year by using the third column. Look at big changes (deltas), and make sure they make sense.

Lines 31 through 41 – These are all your deductions. Line 39 specifically states Itemized or Standard in terms of the deduction taken for routine items such as real estate taxes, state income taxes and mortgage interest.

Tax Computation

Tax ComputationLine 43 is your taxable income, and therefore Line 44 is your tax based on that taxable income but before credits.

Line 57 is your total tax after credits but before income tax withholdings / payments, including “refundable” tax credits.

Sidebar: To take a tax credit such as electric vehicle purchase, you must have a computed tax on Line 44. However, “refundable” tax credits such as some education credits are available even if your tax is $0 on Line 44.

This is where a lot of trouble starts. This figure is the income tax withheld on your paychecks. If you have a big change from last year as compared to this year without a big change in income, this might explain your refund change.

In other words, an increase in income without a corresponding increase in withholdings is a recipe for bad news.

Lines 70 is ultimately what percentage of tax you pay from year to year, or the effective tax rate. There are several marginal tax brackets such as 10%, 12%, 22%, 24%, 32%, 35% and 37% as of 2024. Some of your income is taxed at 10%, and whatever “spills over” is taxed at the next marginal tax bracket. When you blend all these marginal tax rates together, you obtain your effective tax rate which is typically lower than your marginal tax rate (with self-employment taxes or penalties, your effective rate could be higher than your highest marginal tax rate).

So, regardless of the actual income, or tax, or deductions, etc., if line 70 is the same from year to year, your taxes haven’t changed.

| Single 2024 | ||||

| From | To | Rate | Marginal Tax | Total Tax |

| 0 | 11,600 | 10% | 1,160 | 1,160 |

| 11,601 | 47,150 | 12% | 4,266 | 5,426 |

| 47,151 | 100,525 | 22% | 11,743 | 17,169 |

| 100,526 | 191,950 | 24% | 21,942 | 39,111 |

| 191,951* | 243,725 | 32% | 16,568 | 55,679 |

| 243,726 | 609,350 | 35% | 127,969 | 183,647 |

| 609,351 | forever | 37% | ||

| Married Filing Jointly 2024 | ||||

| From | To | Rate | Marginal Tax | Total Tax |

| 0 | 23,200 | 10% | 2,230 | 2,230 |

| 23,201 | 94,300 | 12% | 8,532 | 10,852 |

| 94,301 | 201,050 | 22% | 23,485 | 34,337 |

| 201,051 | 383,900 | 24% | 43,884 | 78,221 |

| 383,901* | 487,450 | 32% | 33,136 | 11,357 |

| 487,451 | 731,200 | 35% | 85,313 | 196,670 |

| 731,201 | forever | 37% | ||

* Start of Section 199A qualified business income phaseout for small business owners.

There isn’t a secret tax deduction club that only a few people know about. If there were, it would be like fight club, right? But trust us when we say no one isn’t talking about a tax deduction club intentionally.

Most people are interested in saving cash when they say they want to reduce or avoid taxes, but saving cash and reducing taxes are not necessarily the same.

Two households, making the exact same income, might have wildly different tax liabilities based on the myriad of variables such as children, mortgage interest, charitable donations, available tax credits, and, yes, the proficiency of the tax professionals involved.

As household incomes travel through the ranges, a lot of things happen. The first $100,000 in income for most households is well-sheltered with itemized deductions and low tax brackets. The next $100,000 in income sees certain tax credits go away, higher tax brackets and fewer available tax deductions such as IRAs and other things (what we call income phase-outs). In other words, if you go from $100,000 to $200,000 in household income, you’ll pay way more than double in taxes (you could easily see 2.5 to 3.0 times more). Yuck! The next $100,000 and beyond is completely naked, and is generally purely taxable (unless some tax reduction tactics are deployed). Super yuck!

Tax deductions and tax deferrals are not the same. Tax deferrals are tax bombs later in life; little IOU’s to the IRS, and they will eventually call in the chit. But if you use the immediate tax savings to build wealth, then a tax deferral is worth it. Deferring taxes to pay for a cruise vacation might not always be the best approach (then again, live a little!).

Tax deductions commonly need separation with cash. For example, you can save $2,500 (for example) in taxes right now if you write a check for $10,000 to a charity. That might not make sense if you are more interested in cash than taxes, right? Tax deferrals commonly require separation with cash as well, but at least you get it back. IRA’s and 401k plans (among others) come to mind.

Every client is different. Having said that, we welcome an opportunity to review your tax returns with you, answer any questions you might have, and ensure a comprehensive and accurate tax return is being submitted to the IRS. We never want to stray away from this level of access and customer service. We live in a virtual world, and we use technology as a tool in the tool box, but we never want to lose focus on our clients’ traditional needs. High-tech versus high touch.

Reviewing your tax returns with us is not required. It’s only offered as benefit to you if you have concerns or questions. Having said that, we love it since we get to chat with you to ensure accuracy and comfort. Please call our office at 719-387-9800 to schedule this review. We typically reserve 30–40 minutes. Additional time is always available, but in our experience, it’s rare.

Yes. The IRS spots you a certain amount every year. The higher of the standard deduction or a tally of your itemized deductions is used.

529 plan contributions are deducted on your state tax return provided certain rules are met and there are limitations. It is not a federal tax deduction (but the earnings grow tax-free if used for qualified education).

The employee (you) deferral is handled through your payroll. If the 401k contribution was pre-tax, then your Box 1 and Box 16 taxable wages on your W-2 were already reduced. If your S Corp made an employer (company) discretionary contribution, this was deducted on your business entity tax return (which lowers in your K-1 income on Schedule E Page 2 on your 1040 tax return).

According to HealthCare.gov, “A tax credit you can take in advance to lower your monthly health insurance payment (or “premium”). When you apply for coverage in the Health Insurance Marketplace®, you estimate your expected income for the year. If you qualify for a premium tax credit based on your estimate, you can use any amount of the credit in advance to lower your premium. If at the end of the year you’ve taken more premium tax credit in advance than you’re due based on your final income according to your tax return, you’ll have to pay back the excess.”

The IRS assesses a penalty for underpayment of your taxes. This happens in two ways:

Keep in mind that a tax return extension is not an extension to pay. Also, it’s common to be penalized even if you’re getting a refund (some taxpayers make one big Q4 estimated tax payment, but the IRS wants their money evenly throughout the year).

If changes are required to your tax returns, we might have to charge additional fees for time spent. It is rare. For example, if the changes are simple such as more charitable donations, or auto registrations, or some other quick change, your fee will usually remain the same.

If changes are required to your tax returns, we might have to charge additional fees for time spent. It is rare. For example, if the changes are simple such as more charitable donations, or auto registrations, or some other quick change, your fee will usually remain the same.

However, extra tax forms or reworked worksheets such as small businesses or rental properties will typically incur an additional fee. We aren’t here to penalize you for ensuring accuracy of your tax returns, but at the same time, additional preparation time beyond what would be normal or typical incurs additional costs.

Paper copies of your tax returns are not automatically sent to you. If you would like a hard copy, we must charge additional fees for printing, binding, and mailing. One suggestion is to download your tax returns to a thumb or flash drive, or use a backup or cloud service. If you really feel nostalgic, burn a CD.

Also, your tax returns are always available 24 hours a day, 7 days a week via your Sharefile.

If a third party, such as a lender, needs copies of your tax returns, we can securely send this information and your source documentation. Just let us know!

Your tax team at WCG CPAs & Advisors appreciates your business and continued trust. If you like how we treated you, please submit a review:

And if you think we could use some improvement, please let us know. We are continuously trying to improve our service, and we appreciate your comments.

Table Of Contents

Tax planning season is here! Let's schedule a time to review tax reduction strategies and generate a mock tax return.

Tired of maintaining your own books? Seems like a chore to offload?

Did you want to chat about this? Do you have questions about Tax Return Review? Let’s chat!

The tax advisors, business consultants and rental property experts at WCG CPAs & Advisors are not salespeople; we are not putting lipstick on a pig expecting you to love it. Our job remains being professionally detached, giving you information and letting you decide within our ethical guidelines and your risk profiles.

We see far too many crazy schemes and half-baked ideas from attorneys and wealth managers. In some cases, they are good ideas. In most cases, all the entities, layering and mixed ownership is only the illusion of precision. As Chris Rock says, just because you can drive your car with your feet doesn’t make it a good idea. In other words, let’s not automatically convert “you can” into “you must.”

Let’s chat so you can be smart about it.

We typically schedule a 20-minute complimentary quick chat with one of our Partners or our amazing Senior Tax Professionals to determine if we are a good fit for each other, and how an engagement with our team looks. Tax returns only? Business advisory? Tax strategy and planning? Rental property support?

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.