Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Hey - Our site just had a makeover and we are sorting through the hiccups!

Hey - Our site just had a makeover and we are sorting through the hiccups!

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Posted Monday, December 2, 2024

Table Of Contents

This is long. No way around it. Grab some coffee, put the phone in a different room, turn off notifications, and please give us 15 minutes of your time.

This is long. No way around it. Grab some coffee, put the phone in a different room, turn off notifications, and please give us 15 minutes of your time.

This business tax return review guide is geared toward Partnership (Form 1065) and Corporate (Form 1120 or Form 1120S) tax returns. Individual tax returns (Form 1040) have a separate tax return review checklist. Click on the button below:

Review your individual tax return using our step-by-step guide and helpful flowchart.

Reviewing and understanding your business tax returns are important things. In our virtual tax preparation world, sitting down with your CPA or tax accountant to review your tax return is a challenge. Today we rely on emails, telephone calls and Teams (screenshare).

People are also busy with life on life’s terms. As such, we developed this webpage to help you review and understand your tax returns, and know the process of approving and filing your tax returns.

Rest assured that if you are concerned or have questions, you can always communicate with us, and we will stop, find some time and review these items with you. That is our promise! We don’t want to lose high touch in a high-tech world.

Here are the final steps necessary for the filing of your business entity tax returns:

We will now discuss these items in more detail. Before we do that, a common question we get is “What are my action items?” Great question! The ActionRequired PDF is your holy grail and contains all your action items, or as the name implies, all your required actions. See below.

It’s a challenge to know if our clients are done sending tax documents to us. So, if you are still waiting on more tax forms from various sources, please let us know. We will suspend your tax returns and complete it when we have all the necessary forms.

Every document and correspondence that was received has been entered into your tax returns. However, mail and internet uploads can still fail everyone. Please follow the steps below to review your tax returns, and ensure there are no omissions or misstatements.

We have created at least TWO tax return PDFs:

One PDF is the full-blown tax return with all the bells and whistles you would expect, plus a lot of stuff you wouldn’t expect. We always give you the complete tax return which goes way beyond the filing copy by providing supporting statements, depreciation schedules, etc.

The other PDF is labeled “ActionRequired” and basically only lists the essential items for filing your tax returns. It includes eFile authorizations, payment vouchers (if necessary) and filing instructions. This file is only about 8–10 pages long, and should be printed and reviewed in its entirety. This is very important! You might be getting a tax refund from the IRS but owe taxes to the state.

Each shareholder in an S Corp or partner in a partnership will have a separate PDF for their K-1 package. A K-1 highlights the distributive share of income and various deductions.

We have sent you your tax returns in two different ways:

We provided links in our tax return delivery email that directly download your tax returns from your Client Portal. Some people are concerned with emailed links, and for good reason. See Client Portal below.

You can also log into your portal using the following link and navigate to your tax year (such as 2022) and then selecting Taxes.

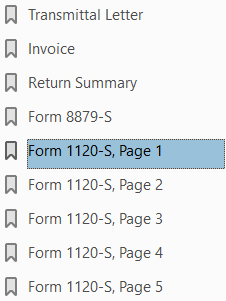

Your tax return PDF is assembled in this order:

Your tax return PDF is assembled in this order:

We cannot file your tax returns unless payment has been made for our preparation fees. A separate invoice will be emailed to you from our workflow software called Canopy.

There are two ways to electronically sign and approve your tax returns for efiling. The old school way is to print Form 8879 contained in the ActionRequired PDF mentioned above, and upload that to your client portal.

Alternatively, and preferred, is to electronically sign the efile authorization request that we send to you through Canopy.

We cannot file your tax returns without the efile authorization forms. Sorry, the IRS can be demanding that way

This is the beginning of your Federal tax return. We will happily walk through each line and figure of these forms. Happy might be a stretch, but we want you to be 100% comfortable with your tax returns. Please see below for some common questions and concerns.

This is a summary of your Federal tax return. Please ensure the amounts “feel right”. Also, use this comparison to help understand differences in tax due or tax refunds from previous years.

See below for more information on reviewing your tax returns.

If your PDF reader has bookmarks in a left-hand viewing pane, you can quickly jump to your state tax returns(s). Adobe should handle this correctly otherwise you’ll need to scroll (sorry).

There are several things we want to bring to your attention.

These are 5-page tax returns with a bunch of supplemental data, similar to a Form 1040. This is the heart of your tax return, and is where all your schedules and other related items are tabulated, and presented to the IRS and local agencies. Please review these pages for accuracy in simple things like spelling and addresses, as well as an overall sanity check on the numbers.

Your individual tax return is summarized on two pages (Form 1040), but partnerships and corporations have a single page and provides an overall summary of income and expenses. Here are some common things to review.

If your corporation or partnership is filing a final tax return, the appropriate box should be checked. If your address has changed, we can use your tax return filing to alert the IRS (states will need additional correspondence). Review your accounting method to ensure accuracy (cash versus accrual).

Line 1 of the tax returns is the gross amount of income reported on your tax returns. Does this appear correct? During the tax return review with you, we will confirm this amount matches your 1099s, point of sale (POS) system, and other income sources.

Oftentimes, a corporation or partnership will make a 401k employer contribution or some other contribution to a profit sharing or defined benefits plan. The problem becomes when the entity writes a check after the tax year is closed. This is not a big deal, but we want to account for the contribution with the associated tax year. Review line 23 (C Corp), line 17 (S Corp) or line 18 (Partnerships) for accuracy.

If you need help setting up a 401k or some other plan, please contact us. SEP IRAs are old school and don’t allow for higher limits or Roth contributions.

Line 26 (C Corp), line 19 (S Corp) and line 20 (Partnerships) is the catch-all for all expenses that don’t otherwise fit in the other categories on the main page of the business entity tax return. Office expenses, mileage, home office, etc. will primarily be listed as Other Deductions.

A statement of all other deductions will be contained in the “Required Statements” bookmark in the left-hand viewing pane of most PDF readers. Please review this carefully.

Partnerships and the occasional S corporation might own a rental property. If so, this information is detailed on Form 8825. This is akin to Schedule E of Form 1040 on individual tax returns.

Generally speaking, S Corps should not own rental properties since this income is considered passive, and could artificially inflate reasonable salaries causing an increased tax burden. C corporations do not have a separate form for rentals.

Schedule L (either page 4 or 5 of the main tax return, depending on the entity) will report balance sheet items. Please review this page for asset totals and loan balances. Schedule Ls are not required for most small businesses under $25M in assets. However, WCG always prepares this schedule since small businesses have a funny way of becoming a big business or if you want to sell your headache to a buyer.

For S corporations and partnerships, your K-1s are included and this is how the business entity profit will flow through to your individual tax returns (Form 1040), and be taxed at each individual owners’ income tax rate. This is why S corporations and partnerships are considered pass-thru entities. If WCG is preparing your individual tax returns, we will automatically include your K-1 detail. If your tax returns are prepared in a different office, please provide the K-1 to be included in your Form 1040.

Please review each K-1 for correct spelling of shareholders or partners, and the correct ownership percentages. Percentages cannot fluctuate from year to year without perfecting the transfer of ownership interests and possible tax obligations.

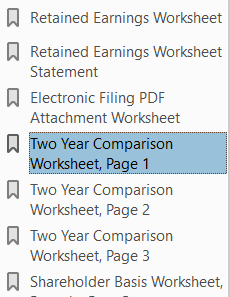

As mentioned, this compares your current tax return data to your previous tax return data. In the accounting and engineering world, we are looking for material deltas (differences) or changes. And yes, as a part of our review process, your tax professionals and managers are reviewing this as well.

As mentioned, this compares your current tax return data to your previous tax return data. In the accounting and engineering world, we are looking for material deltas (differences) or changes. And yes, as a part of our review process, your tax professionals and managers are reviewing this as well.

The Two-Year Comparison is right before the start of the state tax returns. In true comparison fashion, these pages have three columns:

Review these pages! Your Tax Manager will go through these line by line with you to ensure your understanding and the tax return’s accuracy.

A Two-Year Comparison is only created if WCG has prepared both tax returns.

An S corporation or partnership passes its income tax obligation onto the shareholders or partners. However, some states such as Washington, California, Texas, Tennessee, Virginia among several others impose a franchise tax or a pleasure to do business in our state tax. Review the ActionRequired PDF for specific information. We will also review this will you.

Many clients forget to tell us about the following deductions or situations:

If you are concerned about any of these deductions or situations, please review our small business checklist.

Every client is different, and we welcome an opportunity to review your tax returns with you, answer any questions you might have, and ensure a comprehensive and accurate tax return is being submitted to the IRS. We never want to stray away from this level of access and customer service.

We live in a virtual world, and we use technology as a tool in the toolbox. But we never want to lose focus on our clients’ traditional needs. High-tech versus high touch.

Here is a rough framework that we will review with you:

Reviewing your tax returns with us is not required. It’s only offered as a benefit to you if you have concerns or questions. Please call our office at 719-387-9800 to schedule this review. We typically reserve about 30–40 minutes for corporations and partnerships. Additional time is always available, but might incur consultation fees.

If changes are required to your tax returns, we might have to charge additional fees for time spent. Please understand if the changes are simple, such as adding a 401k discretionary contribution that’s normal, and does not incur an additional fee.

However, at times, a business owner is not comfortable with the expenses or other things, and wants to re-reconcile their accounting records. We aren’t here to penalize you for ensuring accuracy of your tax returns, but at the same time, additional preparation time beyond what would be normal or typical incurs additional costs.

Your tax team at WCG appreciates your business and continued trust. If you like how we treated, you please submit a review!

Table Of Contents

Tax planning season is here! Let's schedule a time to review tax reduction strategies and generate a mock tax return.

Tired of maintaining your own books? Seems like a chore to offload?

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.