Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Hey - Our site just had a makeover and we are sorting through the hiccups!

Hey - Our site just had a makeover and we are sorting through the hiccups!

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Table Of Contents

Exit strategies or succession planning usually consider employee ownership as a strong possibility. It is a difficult decision for most business owners since their business is their baby, and the blood, sweat and tears remain a close memory. However, no one gets out of this world alive so like it or not, the exit plan should be discussed.

Some businesses don’t fare as well as others when determining the exit plan. For example, you are a solo attorney working a lot of one and done cases such as divorce or DUIs where there is very little recurring revenue. This is difficult to sell or transition to others since most acquisitions involving personal services are based on future revenue. Take this same solo attorney and consider him or her an estate planning attorney who might have “maintenance agreements” with the clients; this dynamic of future recurring revenue now creates an economic benefit that another attorney might want to acquire. Boom! You’ve created an attraction that can be leveraged into succession.

Some businesses don’t fare as well as others when determining the exit plan. For example, you are a solo attorney working a lot of one and done cases such as divorce or DUIs where there is very little recurring revenue. This is difficult to sell or transition to others since most acquisitions involving personal services are based on future revenue. Take this same solo attorney and consider him or her an estate planning attorney who might have “maintenance agreements” with the clients; this dynamic of future recurring revenue now creates an economic benefit that another attorney might want to acquire. Boom! You’ve created an attraction that can be leveraged into succession.

According the National Center for Employee Ownership website-

The General Social Survey (GSS) data are reported in detail in a separate page on this site. In sum, however, they showed that as of 2014, 19.5% of all employees working in the private sector reported owning stock or stock options in their companies, while 7.2% specifically held stock options. Looked at another way, 36% of employees working for companies with stock (this excludes government employers, nonprofits, partnerships, etc.) owned stock or options in their companies. This means that approximately 32 million Americans own employer stock through ESOPs, options, stock purchase plans, and 401(k) plans

Why? Many employers determine that productivity and employee satisfaction improve when employees have ownership. In addition, employee recruitment and retention are also improved. Employee ownership therefore becomes a part of the continuity or exit plan for many employers.

An ESOP might be a great succession plan. First, what the heck is an ESOP. According to a May 2017 article in the Journal of Accountancy–

ESOPs were created by the Employee Retirement Income Security Act of 1974 (ERISA), P.L. 93-406, and have long been used as a vehicle for ownership succession planning. According to The ESOP Association, there are approximately 10,000 ESOPs in the United States, covering 10.3 million employees. While ESOPs exist in a broad range of industries, they are most prevalent in manufacturing and construction companies, as well as engineering and architecture firms.

The basic gist is that the present owners sell their shares to the ESOP and typically take back a note from the ESOP (a loan). The ESOP can also obtain outside financing to purchase the outstanding shares. From there the business provides the funding to the ESOP to pay its debt obligation. According to the National Center for Employee Ownership and affirmed by a Journal of Accountancy article, the cost to set up an ESOP which includes the feasibility analysis, paperwork and initial valuation ranges from $40,000 to $80,000 (and higher). As such this is requires some careful consideration.

Here are some links-

www.wcgurl.com/6113 (NCEO’s article on ESOPs and S Corporations)

www.wcgurl.com/6111 (Journal of Accountancy on ESOPs in a CPA Firm)

WCG is currently exploring the poor man’s version of an ESOP where our primary entity is a C corporation which has a robust shareholder agreement for buying and selling of shares. While we are sacrificing the huge tax benefits of a true ESOP we are saving on costs and increasing our flexibility. One day we might convert to an ESOP just not today.

Why do you need a shareholder agreement? If you own 5% of a privately held small business you basically own 0%. Huh? Unless there is a market (public or private) where the minority shareholder can sell his or her shares, a 5% ownership in a privately held small business is not marketable and therefore not as valuable. In the business valuation world we call this degradation of value a discount for lack of control (DLOC) and a discount for lack of marketability (DLOM). Here is the IRS Job Aid on Discount for Lack of Marketability.

Why do you need a shareholder agreement? If you own 5% of a privately held small business you basically own 0%. Huh? Unless there is a market (public or private) where the minority shareholder can sell his or her shares, a 5% ownership in a privately held small business is not marketable and therefore not as valuable. In the business valuation world we call this degradation of value a discount for lack of control (DLOC) and a discount for lack of marketability (DLOM). Here is the IRS Job Aid on Discount for Lack of Marketability.

Therefore, a business needs to create a market both on the buy and sell side. For example, CPA firms typically are valued at about 1.0 to 1.5 times gross revenue depending on the quality of book of business (age of clientele, average fee, amount of recurring revenue, etc.). Using our example you could set up a program where an employee could buy shares using a valuation formula. Let’s say you have a CPA firm and you believe the factor is 1.2, and you also wanted to give your employees a 10% discount. You are growing and so you also want to use an average revenue number based on the previous two years to smooth out the value.

Your per share value formula would be (90% x Avg Revenue x 1.2) / number of authorized shares. This could be used for the buy side, and on the sell side.

On the buy side you could allow employees to purchase stock annually. You could also issue shares as a form of compensation (yes, that would find its way onto a W-2). You could also use this arrangement for a future owner where he or she pays some cash and obtains bank financing for the remainder allowing acquisition of a large chunk of stock. Many business-oriented banks will put together a deal where the new owner puts in 20% and the bank finances the 80% using the original owners as a backstop for collateralization. In other words, the sellers or original owners would promise to buy the stock back from the bank upon default, should it occur.

On the sell side you could allow employees to sell annually as well, and only upon separation from the business. By creating a market, a 5% minority ownership now has value. Some other considerations include that no person or entity other than current employees can own stock, and should an employee get divorced he or she cannot give the marital property to the other spouse.

Another consideration is voting rights. Do the minority shareholders have a vote? Perhaps by proxy? Ownership without a voice might not feel like ownership to your employees. How about wholesale sale? In other words, are the majority owners allowed to sell the entire business including the employees’ interests? Do the employees get a first right of refusal to buy out the majority owners?

Our example above was straightforward since CPA firms have enough market data to determine a gross revenue or sales factor. Other businesses use factors as well such as insurance agencies, financial advisor firms, franchised restaurants among several others. If a market approach to valuation using a gross revenue or sales factor cannot be used, a more complicated valuation approach or agreed-upon formula must be used. There are other factors too such as EBITDA (earnings before interest, tax, depreciation, amortization).

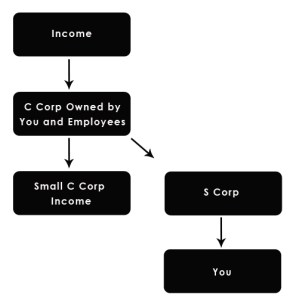

How does the current owner(s) pull money out? Our schematic to the right illustrates an arrangement that could be followed. We can get a bit nutty with the customization of this too… this is very simple but super flexible.

In our arrangement, income flows into the C corporation which is owned by you and your employees. A contractual arrangement would exist where the C Corp would pay your S Corp a management fee leaving a small amount of C corporation income behind (near zero).

This is a generalization and proper consultation with a tax professional (us) and an attorney (others) is a must.

Leaving your business behind to junior still works under the ESOP or home-grown stock purchase plan. They own stock like any other person either acquired through purchase, gifting or upon death.

A plan where employees acquire ownership in the company, often financed by the business itself.

It preserves continuity, motivates employees, and can provide a smooth transition for the owner.

Yes, shareholder agreements and home-grown stock purchase plans offer flexibility at lower cost.

Often through revenue-based formulas or valuation metrics, accounting for minority ownership discounts.

Voting rights can be customized in the shareholder agreement, including proxies or first refusal options.

Typically, only current employees are allowed to buy or hold shares to maintain plan integrity.

Through direct sale to employees, ESOP financing, or management fees paid by the company.

Yes, shares can be gifted, sold, or transferred to children under these ownership plans.

Manufacturing, construction, engineering, architecture, and professional service firms.

Yes, setup including feasibility, paperwork, and valuation typically costs $40K–$80K or more.

Want to talk to us about tax return preparation, tax planning and strategy, and all the other things that go with it? We are eager to assist! The button below takes you to our Getting Started webpage, but if you want to talk first, please give us a call at 719-387-9800 or schedule an discovery meeting.

Jason Watson, CPA is a Partner and the CEO of WCG CPAs & Advisors, a boutique consultation and tax preparation CPA firm serving clients nationwide with 7 partners and over 90 tax and accounting professionals specializing in small business owners and real estate investors located in Colorado Springs.

He is the author of Taxpayer’s Comprehensive Guide on LLC’s and S Corps and I Just Got a Rental, What Do I Do? which are available online and from mostly average retailers.

Table Of Contents

Tax planning season is here! Let's schedule a time to review tax reduction strategies and generate a mock tax return.

Tired of maintaining your own books? Seems like a chore to offload?

Did you want to chat about this? Do you have questions about us? Let’s chat!

The tax advisors, business consultants and rental property experts at WCG CPAs & Advisors are not salespeople; we are not putting lipstick on a pig expecting you to love it. Our job remains being professionally detached, giving you information and letting you decide within our ethical guidelines and your risk profiles.

We see far too many crazy schemes and half-baked ideas from attorneys and wealth managers. In some cases, they are good ideas. In most cases, all the entities, layering and mixed ownership is only the illusion of precision. As Chris Rock says, just because you can drive your car with your feet doesn’t make it a good idea. In other words, let’s not automatically convert “you can” into “you must.”

Let’s chat so you can be smart about it.

We typically schedule a 20-minute complimentary quick chat with one of our Partners or our amazing Senior Tax Professionals to determine if we are a good fit for each other, and how an engagement with our team looks. Tax returns only? Business advisory? Tax strategy and planning? Rental property support?

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.