By Jason Watson, CPA

Posted Wednesday, October 20, 2021

We might lose our minds the next time Congress acts over the holidays and ruins our eggnog. At least Wisconsin won the Orange Bowl which is nice. How does the Section 199A phaseout work?

- Let’s say your taxable income is $340,000 which is exactly 25% over the $315,000 income trigger when compared to $415,000. Again, the trigger of the phaseout is based on taxable income and not just net business income.

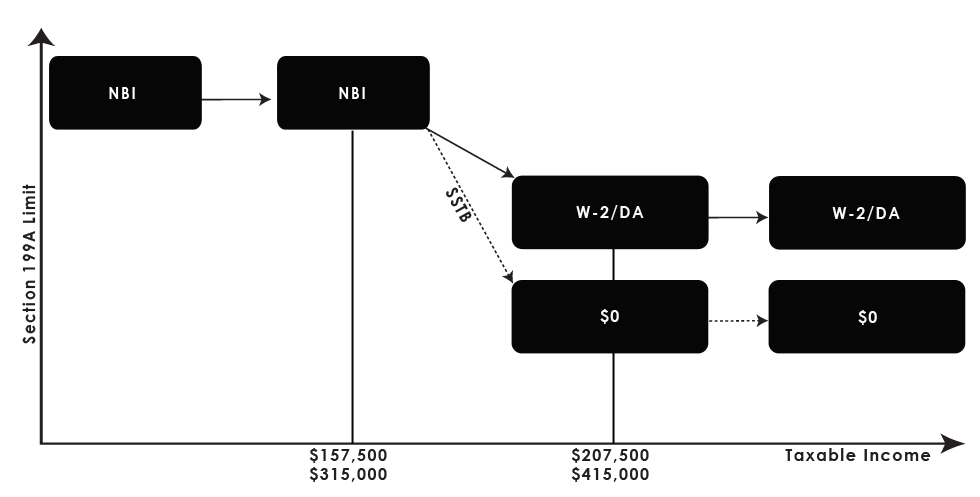

- We determine your Section 199A upper limit based on net business income, with an adjustment for specific service trades or businesses.

- We next determine your Section 199A lower limit based on W-2 / depreciable asset calculation from above, with a similar adjustment for SSTBs.

- Next, we take the difference, multiply it by the percentage of taxable income that exceeds the trigger (in this example, 25%) and reduce the Section 199A deduction based on net business income by this amount. Tilt! A table is coming up.

Here is table that attempts to summarize what the heck we are talking about.

| Taxable Income | 340,000 |

| Phaseout Trigger | 315,000 |

| Amount That Exceeds | 25,000 |

| Phaseout Range | 100,000 |

| Percentage of Phaseout | 25% |

Since the taxable income trigger of $315,000 is exceeded by $25,000 and the phaseout range is $100,000 for married taxpayers, we are 25% into the phaseout range. We now have to split these up between non-service and service.

This gets really funky really fast. For the non-SSTB people, the math is straightforward. For the specific service trade or business people, we need to determine how much of the remaining phaseout range is available. In this case, 25% of the phaseout range is “used up” leaving 75% remaining.

| Non-SSTB | SSTB | |

| Net Business Income | 300,000 | 225,000 |

| Section 199A on NBI | 60,000 | 45,000 |

| W-2 Wages Paid | 100,000 | 75,000 |

| Section 199A on W-2 | 50,000 | 37,500 |

Therefore, 75% of the NBI of $300,000 is $225,000. 75% of the W-2 wages paid of $100,000 is $75,000. These remaining amounts are the basis for the original Section 199A calculations of 20% of net business income, or $45,000 above… and 50% of W-2 wages paid, or $37,500 above.

Another way to look at this is 75% is the remaining Section 199A benefit for the SSTB people. Therefore 75% of the net business income limit of $60,000 is $45,000… and 75% of $W-2 limit of 50,000 is $37,500.

This creates an “upper limit” and a “lower limit” which further creates the difference to apply the phaseout range percentage (in this example, 25%).

| Non-SSTB | SSTB | |

| Section 199A Upper Limit | 60,000 | 45,000 |

| Section 199A Lower Limit | 50,000 | 37,500 |

| Difference | 10,000 | 7,500 |

Finally, we choose the greater of the Section 199A based on net business income and the Section 199A based on W-2 wages paid. In our example, $60,000 and $45,000 respectively.

This is then reduced by the percentage of phaseout range multiplied against the difference. In this example, 25% of $10,000 and 25% of $7,500 for the specified service business.

This summarizes the Section 199A reduction and ultimate deduction.

| Non-SSTB | SSTB | |

| Section 199A on NBI | 60,000 | 45,000 |

| Section 199A Reduction | 2,500 | 1,875 |

| Section 199A Deduction | 57,500 | 43,125 |

This should make sense. Another way to look at this- let’s say your taxable income was exactly $415,000. You would be 100% into the phaseout range, so your Section 199A deduction would be reduced by $10,000 (100% of the difference of $10,000) for a non-service trade or business. This would also magically equal the Section 199A limit set by 50% of your W-2 wages paid or $50,000.

Extending this logic would suggest that a specified service trade or business who has $415,000 in taxable income would have his or her Section 199A deduction reduced by 100% since the remaining amount of the phaseout range is 0%.

Need a drink?

Wanna Talk About Your Small Business?

Please use the form below to tell us a little about yourself, and what you have going on with your small business or 1099 contractor gig. WCG CPAs & Advisors are small business CPAs, tax professionals and consultants, and we look forward to talking to you!