By Jason Watson, CPA

Posted Tuesday, July 6, 2021

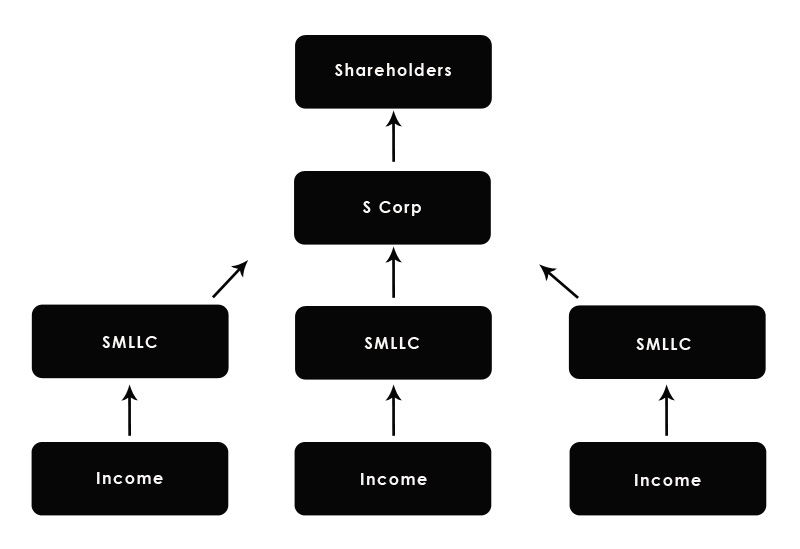

You might have two business entities, and you want to combine them but they are also very different. For example, you are a realtor and your spouse is an IT consultant. We could create a holding LLC called Smith Ventures which owns the realtor LLC and the IT consultant LLC. In other words, the realtor LLC and IT consultant LLC have a single-member, and that single-member is the holding LLC.

The holding LLC would then make the S Corp election, and all the LLC income (realtor and IT, using the example above) would flow into the S corporation as wholly owned subsidiaries. Remember, single-member LLCs are disregarded entities and are reported on the sole member’s tax return. In this case the sole member is a sexy and tax-efficient S corporation. Sexy and tax-efficient… probably went too far with that one. The again it is called an S Corp election for a reason, and not a U Corp election.

You might be saying, “Yeah, but, why not just have two S Corps?” You can, and in some situations you must (like an attorney and doctor as a married couple). The downside is the additional costs in tax return preparation and payroll processing. Conversely in the arrangement above, all the payroll for the shareholders is handled out of a single S Corp. Each single-member LLC (SMLLC) is a disregarded entity and therefore only a singular tax return is required at the S corporation level.

We rattled that off fairly quickly. Let’s break it down with some specifics. An S corporation tax return preparation fee is generally $1,500 to $1,800, and the cost of processing shareholder payroll is about $1,200 annually. Let’s call this $3,000. By having two S Corps, you added $3,000 to your overall legal and professional services budget perhaps unnecessarily. Then again if a little division between you and your spouse keeps the pillow talk on the positive side, then perhaps $3,000 is cheap therapy.

Another benefit is that one of these business units, subsidiaries or whatever you want to call them can be carved away and later sold off. You could also expand ownership in one without expanding ownership in the whole structure (we’ll show this later in the chapter).

Let’s move onto the minor inconveniences. Each entity should have its own checking account and set of books. Common expenses such as an umbrella policy or tax preparation fees would be paid at the S corporation level, while subsidiary-specific expenses such as website hosting would be paid at the LLC level.

Also, if you want to take a distribution out of one of the subsidiaries, truly the S corporation would receive the distribution first, and then make another distribution to you, the shareholder. A double hop, and what is referred to as a trampoline in the drug trafficking business (fire up Narcos or Snowfall… great shows!). In other words, transfer money from the SMLLC’s checking account to the S corporation’s checking account to your checking account. Please don’t take it directly from the subsidiary.

Another inconvenience is that each entity might be slapped with high annual fees from the state in the form of filing fees, or franchise taxes (like California) or both. For example, if this arrangement was in California, there would be a minimum of $800 x 3 in franchise taxes. Nasty! The benefits might still outweigh the costs but be careful.

This is a common strategy between husband and wife teams where the business entities are completely different, yet the household wants to enjoy the benefits of an S corporation.

Side Bar: We must analyze limitations in each of the subsidiary LLCs. For example, you cannot have an LLC that would be deemed a hobby tucked under the “protection” of an S Corp. Each LLC must have a profit motive. There might be other limitations at the LLC level, but the hobby loss limitation is a wonderful illustrative point.

Want another? Section 199A Qualified Business Income Deduction has limitations for Specified Service Trades or Businesses (SSTB). Therefore, if one SMLLC is deemed an SSTB and another SMLLC is not, there will be some extra math calculations in determining the Section 199A deduction.

Expanding Ownership

Expanding ownership will be discussed in more detail in a later chapter, but we quickly wanted to add some more reasons for the compartmentalization of your multiple business units into LLCs. Let’s say you have a home inspection business and a home remodel business. Like the real estate holding company / operating company arrangement, you might want to expand ownership in the remodeling business unit and not the inspection business unit.

For example, you add a partner to the home remodeling LLC and it suddenly becomes a multi-member LLC (the MMLLC above). This entity would have two members; your S corporation and the other guy. The other guy could be an S corporation as well. In this schematic you would need two business entity tax returns; a Form 1120S for the wholly owned S Corp and a Form 1065 for the MMLLC (Partnership Tax Return). Your S Corp would receive a K-1 from the MMLLC.

A Twist

You could also have the SMLLCs remain owned by each spouse individually. The SMLLCs could then pay the S Corp for services rendered, like a management fee, driving the SMLLC income down to a nominal amount, like $500. Why?

401k plans have all kinds of rules on controlled groups and discrimination rules, and we’ll explore more of that later in another chapter. However, if husband owns SMLLC “A” and wife owns SMLLC “B,” each business can have a separate 401k plan. One could be filled with employees, and the other is just a solo 401k plan. This is provided that the spouses don’t participate in each other’s business (again, more on this narrow exception to controlled group rules in a bit).

We discuss holding companies and management companies, and how they are different, later in this chapter.

Wanna Talk About Your Small Business?

Please use the form below to tell us a little about yourself, and what you have going on with your small business or 1099 contractor gig. WCG CPAs & Advisors are small business CPAs, tax professionals and consultants, and we look forward to talking to you!