By Jason Watson, CPA

Posted Saturday, November 5, 2023

What if the structure did not have any employees and only had owners? This changes the rules a bit since now discrimination, or specifically, exclusions are allowed within 401k plan documents.

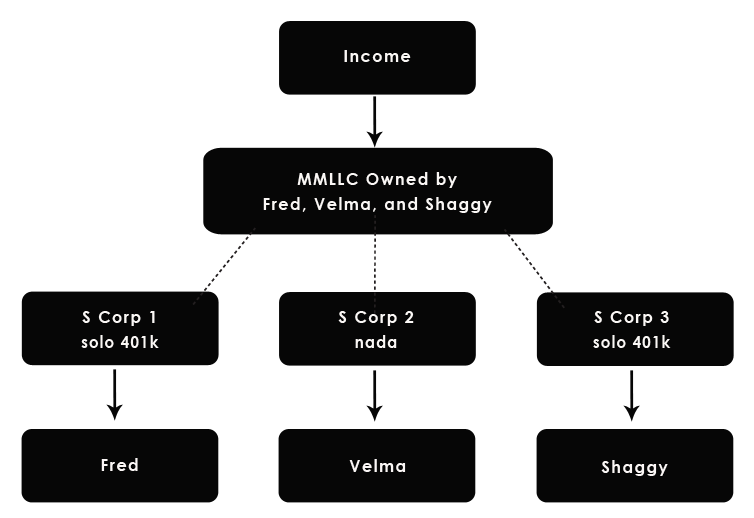

Let’s also go back to our example and say that Fred and Shaggy all had created solo 401k plans for each respective S Corp. This works, but only if there are no other employees other than owner-employees.

Here is how it looks-

In other words, Fred could put away $69,000 (for the 2024 tax year) into his 401k plan while Shaggy only contributes $15,000 into his 401k plan. These plans are independent and are not cross-tested, and as such each owner can do his or her own thing.

As you can see Affiliated Service Groups and 401k plans don’t defeat the beauty of the MMLLC – S Corp schematic, it just makes it a bit more complicated. There are more rules about FSOs, ASGs, A-Orgs and B-Orgs… nauseating. Just remember the possible issues and do the homework. WCG works with a handful of Third-Party Administrators (TPAs) who can give you deeper advice and defend the 401k and profit-sharing plans.

Here is a link to our referrals document-

401k plans are about $1,000 to $1,500 annually yet piggybacking a profit-sharing plan will add additional fees. You can custody the plan assets with any custodian who accepts outside retirement plans and TPA services.

Jason Watson, CPA, is a Senior Partner of WCG CPAs & Advisors, a boutique yet progressive tax,

accounting and business consultation firm located in Colorado serving clients worldwide.

Taxpayer's Comprehensive Guide to LLCs and S Corps 2023-2024 Edition

This KB article is an excerpt from our 400+ page book (some picture pages, but no scatch and sniff) which is available in paperback from Amazon, as an eBook for Kindle and as a PDF from ClickBank. We used to publish with iTunes and Nook, but keeping up with two different formats was brutal. You can cruise through these KB articles online, click on the fancy buttons below or visit our webpage which provides more information at-

| $59.95 | $49.95 | $39.95 |

Taxpayer's Comprehensive Guide to LLCs and S Corps 2023-2024 Edition