By Jason Watson, CPA

Posted Thursday, October 19, 2023

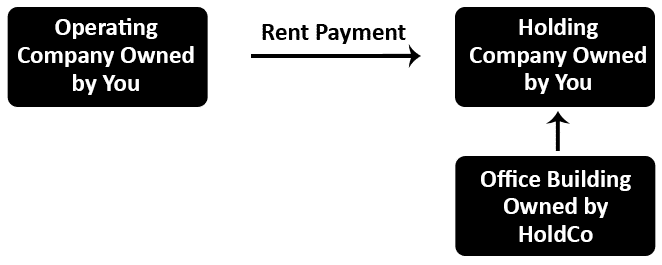

This is one of the most common situations where you own two entities that conduct business between themselves. For example, you are a typical poor accounting firm with the usual high maintenance clients, and you feel that everything would be better if you also owned your own office building. You would create an LLC as the real estate holding company which owns the building, and another LLC (and probably taxed as an S Corp) for the operating company.

This allows for some excellent ownership separation. For example, if you and your father-in-law own the building, he doesn’t have a stake in your accounting firm, and vise-versa (didn’t we just scare you with this idea, and now we are bringing it up as an example… we’re evil). You might also want to make one of your key employees a business partner in your operations, but he or she should not have a stake in the building. Chinese Wall. Can we use Chinese Wall as a separation analogy anymore? We likely offended someone.

The holding company and operating company arrangement can also reduce self-employment taxes or payroll taxes since this conduit changes the color of money. Huh? As discussed in an earlier chapter, your accounting firm’s income is earned income, taxed both at the self-employment tax level (or payroll tax level) and the income tax level. However, you reduce this earned income by the amount of rental expense and that subsequent rental income on the other end is considered passive and only taxed at the income tax level (technically non-passive since it is a self-rental under Section 469, but let’s not muddy the waters).

Beauty! You must have a lease and the rent must be market rates; usually a rent appraisal from an independent appraiser will suffice. The rent appraisal is also a good idea in the expansion of ownership. For example, Jason and Tina Watson own the building that WCG leases. As WCG expands its ownership to other partners, the rent payment to Jason and Tina needs to be above reproach; ergo, a rent appraisal. This reduces office politics and hurt feelings. Maybe just office politics.

Wanna Talk About Your Small Business?

Please use the form below to tell us a little about yourself, and what you have going on with your small business or 1099 contractor gig. WCG CPAs & Advisors are small business CPAs, tax professionals and consultants, and we look forward to talking to you!